Global food shortages. An energy crisis. The devaluation of the American dollar.

The Great American Reset

Global food shortages. An energy crisis. The devaluation of the American dollar.

The Great American Reset

Over the next two years, America will go through the most turbulent transformation of our lifetime.

Here’s how you can protect yourself during this crisis, and potentially even grow richer.

America as we know it is about to change.

I believe long-term, this change will be for the better.

But to get there, you, me, and every other American citizen will have to live through an unprecedented level of chaos…

Unlike anything any American has ever experienced.

Yes, what is coming down the pike in the next two years will make the Great Depression look tame.

The events of the past two years have just been a warmup.

Skyrocketing gas prices…

Run-away inflation that’s making it hard to put food on the table…

Mass shortages in everything from semiconductor chips and lumber, to toilet paper and cars.

Escalating tensions with Russia and China, two nuclear-armed nations…

And the degeneration of once-great American cities into crime-ridden hellholes.

If you’re wondering, “How could things get much worse?”

Well, here’s how:

Everything we’ve experienced as a nation over the past two years are only the warning tremors before the earthquake.

And when that earthquake hits, it will rock America to its core.

Over the next two years, the entire post-World War II order will be reshuffled…

Sending reverberations through every part of our society, from the federal government all the way down to our neighborhoods and family.

Now, I’m not a doomer:

America will emerge out of the other end.

And I sincerely believe that we will be a better country for it.

This approaching chaos will kill many of the dumb ideas that have penetrated our culture…

And the political changes will get rid of the corrupt politicians who have been looting America for the past fifty years.

The new America that emerges will be far more in line with traditional American values than the country we live in now.

It will be a real America.

And:

If you are able to navigate the chaos of the next two years, you will have the opportunity to massively grow your wealth in this new America.

But before this new America emerges, things will get worse.

Inflation will continue to spiral out of control.

And large parts of the stock market will collapse.

Because of this, the retirement that you worked so hard to build will have a large chunk of it eaten away.

And shortages, resembling the dredges of Soviet Communism, will sweep through American cities and towns.

The necessities of life, everything from gas, electronics, furniture, and even food, will become increasingly hard to find.

I want to reiterate:

These next two years will be rough.

But during all of this chaos, there will still be a chance for you to not just protect what you already have…

But to actually reverse the odds and grow wealthier.

Positioning yourself correctly now will allow you the chance to weather the coming storm better than 99% of other Americans.

Because there are a small number of stocks that I believe will profit from this chaos.

And when the stock market finally does rebound…

Those gains will kick into overdrive, which means you could multiply your wealth many times over during the next great American renaissance.

So, buckle up, because I’m going to show you everything you need to know right now.

My name is Ross Givens…

You may have seen some of my appearances on Fox Business with Stuart Varney...

BNN Bloomberg...

Or CNBC.

I’ve built a career by placing myself where the money is.

I got a degree in finance, then went to work for a handful of brokerages and wirehouses.

I even ran a managed fund that specialized in trading commodities futures.

My work got me noticed by a major Wall Street bank, who hired me as a Vice President.

We managed billions in assets for some of the most affluent individuals in America.

I was inside the belly of the beast for more than a decade.

I witnessed the financialization of the American economy.

And I took part in the enormous amount of wealth all that cheap money created.

And you did too – if you were invested in the stock market at all.

But the truth is, the greatest bull market of all time – the one we lived through from 2008 until 2022 – is over.

And it’s time to pay the piper.

Things are going to get rough over the coming months.

Much rougher than anything we’ve experienced in our lifetimes.

The Great American Reset threatens to destroy everything that you've built for your family.

And it will unfold in three distinct phases.

Let me ask you this:

What makes America so great?

When you think of what makes America such an exceptional nation, most people would point to our culture of freedom…

Our ethic of hard-work…

Or our capacity for constant innovation.

While all of these do contribute to American exceptionalism…

What makes America truly dominant, what gives us the ability to lead the world in culture, technology, military might, and freedom is…

Energy.

It’s our #1 advantage.

No other people, in the history of the world, have had such enormous reserves of cheap, accessible energy at their fingertips.

Since the moment our ancestors first touched down at Jamestown in 1607, America has been blessed with virtually limitless energy.

During the birth of our nation, this energy came in the form of wood and water.

Then it was coal.

And now, oil and natural gas.

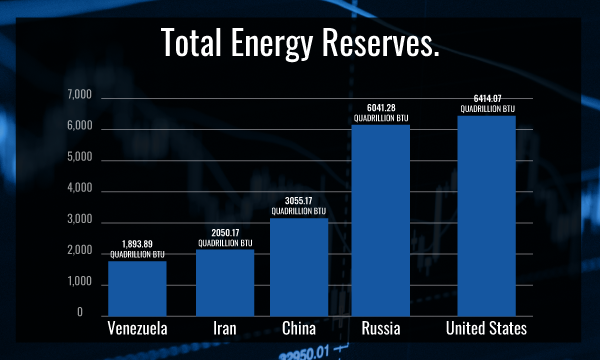

The United States has the most energy reserves of any country in the entire world.

Yes, more than Saudi Arabia, more than Russia or Venezuela, more than China.

But it’s not just our reserves that make us unique.

American innovation has created the greatest energy refinement and output industry in the world – we produce 18% of all the world’s oil, 20% of the natural gas…

And place third in coal production behind China and India.

Simply put, we are an energy juggernaut.

And with that energy, comes food, comes industry, comes innovation, comes everything that makes America so great.

Just look at the numbers:

In 2019, America was energy independent for the first time in 62 years.

We were exporting oil and gas around the world.

And here at our pumps, gas was just around $2 a gallon.

Is it any wonder then that the unemployment rate was at 3.5%, the lowest it had been in 50 years?

Or that wage growth was the highest it had been in decades?

Or that the poverty rate – at 10.5% -- was the lowest it had been since 1968?

It’s not a stretch to say that cheap, abundant energy is the lifeblood of the economy…the foundation of our freedom.

And America is blessed with virtually unlimited reserves of it.

We could be energy independent for the next two centuries if we wanted to be.

But our elites are trying to destroy this independence.

You may remember during the 2020 election, when Biden said: “I guarantee you, we are going to end fossil fuel.”

And he wasted no time making good on his promise.

On his first day in office Biden banned the Keystone Pipeline. In one stroke of the pen, America was cut off from 900,000 barrels of oil per day and 11,000 jobs were killed.

He banned new oil and gas leases, kneecapping America’s domestic energy production and making us more dependent on Saudi Arabia and Russia.

The Biden administration implemented an $8 billion tax on natural gas production.

Guess who’s going to pay that? You, the American taxpayer.

Because the energy companies are just going to pass that tax cost on to you.

And you’ll be paying more to heat your home.

Biden also raised the royalty rates on oil and gas leases by 50%...

Directly increasing the cost of gas at a time when Americans can barely afford to fill up their cars.

Not only that, but he blocked all energy infrastructure for domestic use, only allowing pipelines for export terminals.

All it takes is a trip to the gas pump to see the disastrous results of Biden’s actions.

Gas climbed to the highest price it’s ever been in American history.

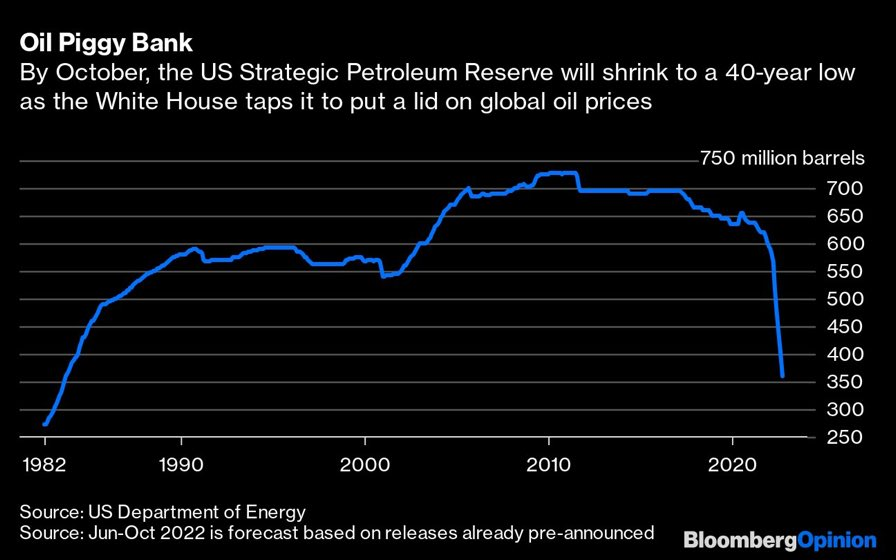

And after a year of just telling Americans to “deal with it,” Biden chose to release our strategic petroleum reserves.

Did it bring gas prices down a little? Sure.

But it also drained our strategic oil reserves.

Right now, they’re the lowest they’ve been since 1984.

And what’s going to happen when we’ve run through those? Because the strategic oil reserve is just a Band-Aid to cover up Biden’s energy policy blunders.

Nothing of the issues that made gas so expensive were fixed.

And once those strategic reserves are depleted, the price at the pump is going to climb right back up to where it was.

Of course, none of this affects the coastal elites in the urban centers of America like Washington, D.C...

In fact, the one pipeline that the Biden administration did greenlight runs from West Virginia to – can you guess where – northern Virginia.

Where all the political elites live.

But for the moms and dads, the hard-working tradesmen, the men and women who keep this country running…

Who live outside of the bubble?

Each trip to the gas station makes them poorer…digs into their savings…reduces their economic security at a time when they can least afford it.

But the consequences of high gas prices go far beyond the pump.

Like I mentioned, our entire economy depends on energy.

Want to order an Amazon package? The truck needs fuel to get there.

Want to build a house? It takes energy to produce cement, to cut down lumber, to transport all the materials.

And the list goes on. Manufacturing, shipping, agriculture – energy is the single thing that connects every piece of our economy.

And the Biden administration is systemically crippling all of it.

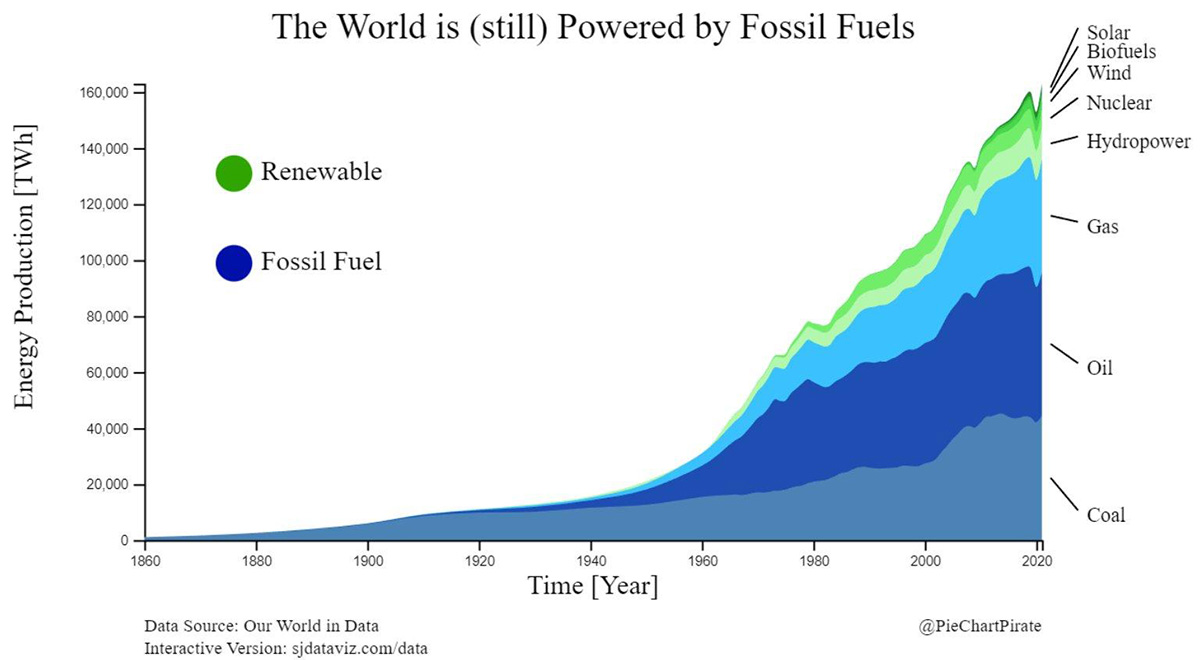

Maybe they’re evil, or maybe they’re just plain dumb, but they really think that “green energy” can replace the fossil fuel industry that they’re destroying.

But what do you think?

Green energy can only provide a small sliver of the world’s energy needs.

Just look at Europe.

They’re even more green crazy than the Biden administration.

And ever since Russia cut off their fossil fuels, things aren’t going so hot.

They stand on the brink of an entire societal collapse. Simply because they refuse to see the truth:

That we still need fossil fuels.

In September, Russia shut down the Nord Stream Pipeline.

In one stroke cutting off all of Europe from its primary energy source.

For years, Europe has been closing its coal and nuclear power plants.

This made them entirely reliant on Russian gas to not just heat their homes, but to power their entire industrial sector.

Funny enough, in 2018, President Trump told a German delegation at the United Nations that “Germany will become totally dependent on Russian energy if it does not immediately change course.”

You know what the Germans did?

They laughed at him. Literally.

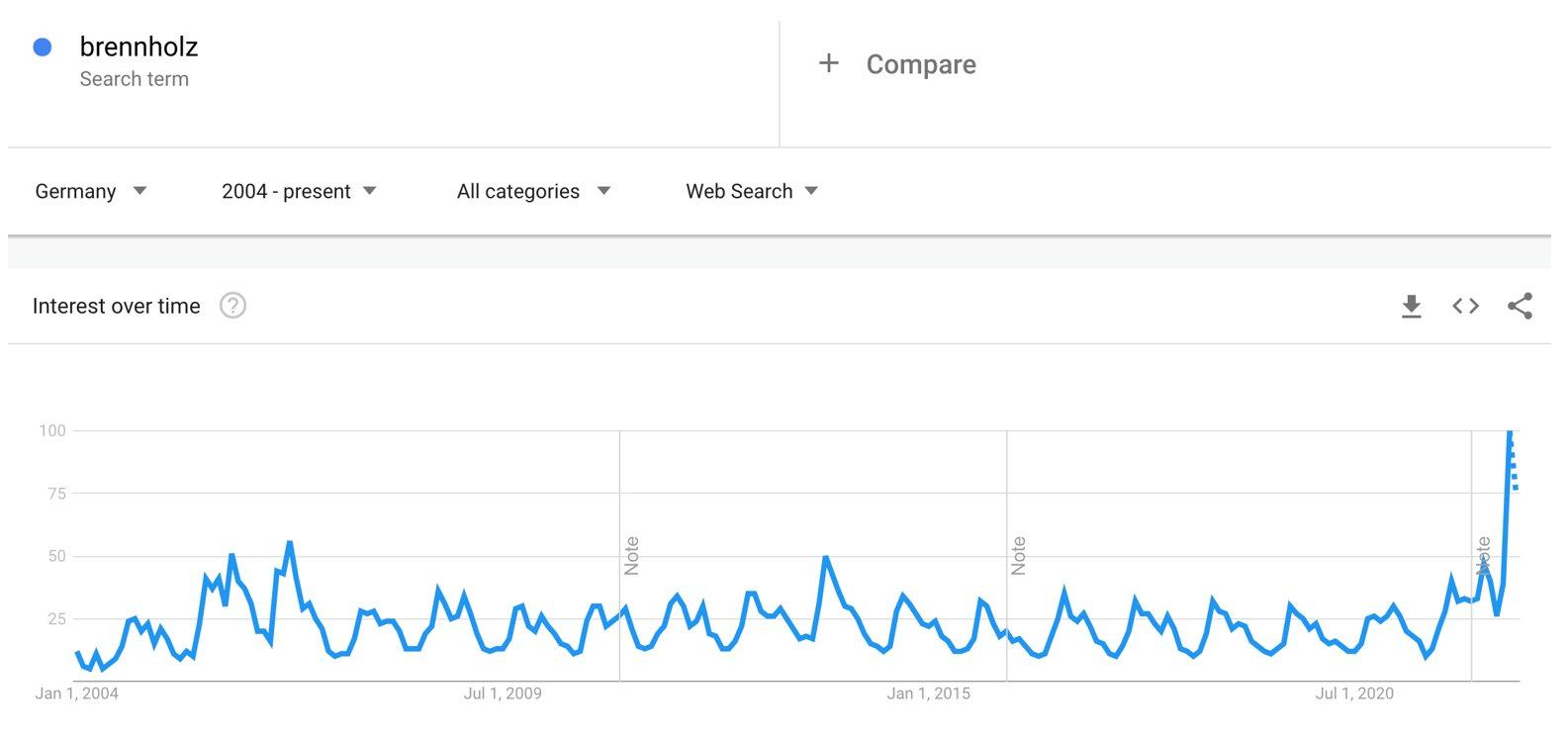

Fast forward to 2022, and searches for “firewood” in Germany are skyrocketing.

Because there won’t be any fuel for Germans to heat their houses with this winter.

The only path forward is for Europe to find someone else to get their natural gas from.

And remember, America just so happens to have the cheapest natural gas on the planet.

And:

For the foreseeable future, our companies are going to be supplying Europe with the natural gas they need to function as a society.

Which brings me to the Great American Reset Stock #1.

Now I know what you’re thinking:

Yes, Biden is doing everything he can to attack American energy production.

But he’s not a dictator, he can’t override the law.

And while his policies might destroy future energy projects...

For the companies that are operating right now, the ones that have signed multi-year contracts, leases, and permits…

The Biden climate czars are powerless to stop them.

And the energy crisis is allowing these companies to make money hand over fist.

Like Great American Reset Stock #1.

This company is primed to become the major liquid natural gas (LNG) provider to all of Europe.

Since the Russia Ukraine war broke out, they’ve inked major contracts with energy companies in France, Norway, Switzerland, and Spain.

Totaled up, this company will soon be shipping 150 million tonnes of LNG.

And not just to Europe either. They’ve also inked supply deals with energy companies in South Korea, Japan, and China.

Now, this is the best part:

Each of these deals is locked in for an average of 17 years.

And they were all signed in just the past few months, when natural gas has been at its highest price in more than twenty years.

Which means it doesn’t matter if the Russia-Ukraine war ends tomorrow, and the Nord Stream pipeline opens back up.

It doesn’t matter if the price of natural gas goes to $1 dollar.

The Great American Reset stock #1 has locked in massive profits for decades to come.

And the balance sheets show it.

Their revenues are already up by 165% since last year.

They’ve raked in over $8 billion dollars in just the first half of the year.

But as good as things are going for this stock, they’re about to get much, much better.

Because they’re nearing completion of a second LNG export terminal.

Once this terminal comes online, they’ll be able to nearly double their export capacity, and deliver even more LNG to Europe and Asia at premium rates.

And again, these deals are locked in until the 2030s.

So, if you want to talk about stability during a time of chaos, this is it.

Now, there’s two ways you could win with this stock.

The first one is obvious:

I believe the share price will double over the coming months and years.

And depending on how much you put down, this gain alone could allow you to outpace inflation.

But more than that, as this company’s free cash flow is increasing, they’re also increasing their dividend.

They just upped it by 20% this year alone!

So, not only will they offer you significant growth potential, but you’ll also be able to cash in on what should be a steady dividend income to weather the approaching storm.

And I’ll bet that any form of extra income you can squeeze out over the next couple years will be worth it.

Because even though President Biden is screaming as loud as his aged lungs will let him that “he beat inflation”.

The reality is, inflation isn’t beaten.

It’s about to get a lot worse.

Especially with our food supply.

And once again, Biden’s energy policies are to blame.

You see, fossil fuels are an irreplaceable part of our food supply chain.

Natural gas accounts for up to 90% of the cost of producing nitrogen fertilizer.

But over the last two years, natural gas prices have skyrocketed more than 900%.

Which has caused the cost of nitrogen fertilizer to jump nearly four fold.

And everything from poultry, and beef, to soybeans, and corn are getting more expensive to produce.

You can see the effects of this at the grocery store.

The cost of fruit is up 21% from a year ago.

Vegetables are up 65%.

Eggs – up 171%.

And meat prices – including chicken, pork, and beef – are up 22%.

Is it any wonder then that Americans can barely afford to survive?

Total American consumer debt is a whopping $16 trillion.

Credit card debt is growing at its fastest rate in 20 years.

And 6 out of 10 Americans don’t have $500 in savings.

As a country, we’re in a dire economic situation.

Right now, the official government numbers put inflation at 8.3%.

But we all know that the “official” numbers don’t tell the whole story.

In fact, the minute he took office, the Biden administration changed the way inflation was calculated, removing energy and food prices from the core CPI measure.

And we’ve all seen how much those two things have risen.

So, in reality, inflation is likely 13-16%. Or higher.

Which would mean that inflation is right now over double what it was during the 1970s.

And unlike the 1970s, the Fed simply can’t raise interest rates enough to tamp the inflation down.

Back then, the U.S. government debt to GDP ratio was 30%.

Now?

It’s 125%.

If Fed chairman Jerome Powell were to hike interest rates to their 1970s levels of 12%...

The interest payments on our debt would be equal to ALL of the government’s revenue.

The results of that would be apocalyptic.

We’ve already seen the consequences of just the few small rate increases the Fed has done over the last 12 months.

Since March 2022, the fed has increased the rate five times, from a low of 0.25% to 3.25%.

And what’s been the result?

New housing starts are plummeting to a two-year low.

Mortgage rates are skyrocketing to their highest point in nearly twenty years.

$7 trillion has been wiped from the stock market in just 2022 alone.

Layoffs are sweeping through the economy as companies tighten their belts.

And the economy is grinding to a halt.

The truth of the matter is, our economy is so fragile, that just a few more interest rate increases could send it into a Great Depression-level tailspin.

So, what can the Fed do?

The truth is, they have very few options.

You see, our leaders have mismanaged our nations’ finances so poorly that we’re trapped in a debt spiral.

A debt spiral is easy to understand.

We all know that the government operates at a deficit.

And as the deficit grows, the U.S. simply issues more debt to cover the gap between revenues and expenses.

But here’s where the problem is:

As interest rates rise, the costs of borrowing rise with them.

So, let’s do some quick math:

The government brings in $4.8 trillion in tax revenue a year.

It spends $3.7 trillion on entitlement programs, like Social Security, Medicaid, and Medicare.

And it spends another $800 billion on the military.

So, you have $4.8 trillion in revenues - $4.1 trillion in expenses.

$300 billion left over for interest payments on our national debt.

But here’s where it gets crazy.

At current interest rates, the interest payment on our nearly $30 trillion worth of debt is $400 billion.

So, $300 billion minus $400 billion…

We’re already in the hole by $100 billion.

In other words, we’re insolvent.

At current interest rates.

If J. Powell and the Fed were to raise rates like Volcker did in the 1970s – say to 10% -- the annual interest on our national debt would total a whopping $3 trillion.

It’s hard to comprehend how large a number that is.

It’s so large, in fact, that the Fed will never do it.

Because we simply can’t afford it.

Instead, this is what I expect will happen over the next 12 months:

The Fed will raise the interest rates to just under 5%.

This will crater the economy, but not put us in Great Depression level territory.

Then, when government inflation numbers reach somewhere between 3-4%, the Fed will declare victory, say that inflation has been brought down, and resume quantitative easing.

I expect the next phase of money printing will resume sometime in mid-2024.

Nothing will have been solved.

Nothing will have been fixed.

Instead, America will be trapped on a narrow walkway – on one side is a massive economic depression, on the other hyperinflation.

And somehow, the Fed will have to keep up on this narrow path for basically, all time.

If that sounds like a tall order, you’re not wrong.

At the very least, we’re going to be living with persistently higher inflation.

At the worst, the U.S. will fall into a depression.

Or on the other side, hyperinflation.

No matter which of the three outcomes unfolds, the way to protect yourself is the same:

You have to invest in hard assets.

If you can buy bullion gold, or silver, or copper, or anything like that, I highly recommend that you do.

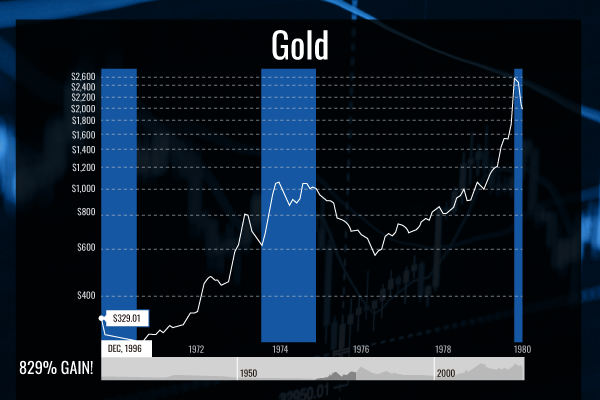

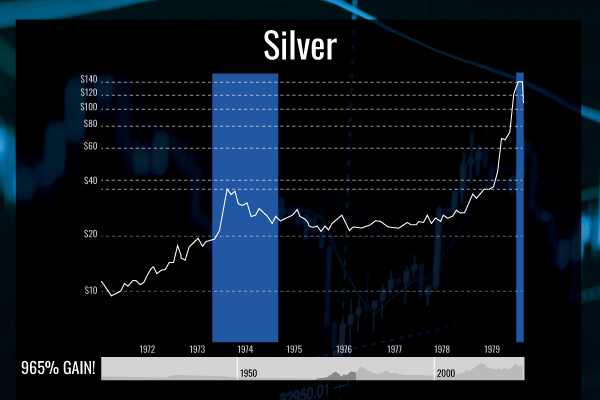

The last time our country was facing a similar situation -- from 1970 to 1980.

The price of gold skyrocketed 829%.

Silver jumped 965%.

And copper? 169%.

And I’ve already shown you how inflation is much, much higher than it was then.

And it will probably persist for just as long.

So, buying any of these hard assets could hand you big gains over the coming years…

And help you outpace inflation.

But:

There is an easier way to invest in hard assets, without having to search for them, buy them, ship them, and store them.

Instead, you can buy shares in mining companies.

This way, you can get exposure to gold, silver, and copper, with just the click of a button.

The Great American Reset Stock #2 is a copper and gold miner, with mines in the U.S., Turkey, Finland, and Canada.

Their two gold mines are some of the lowest cost mines in the world…

With some of the highest-grade gold to boot.

Last year, their mines produced nearly 73 million pounds of copper and 308,000 ounces of gold.

And those numbers are set to grow much larger.

This company is in the process of opening a new gold mine in Nevada as we speak.

Which means as inflation rages on, and more and more investors look to metals for protection…

I think This gold miner will be perfectly positioned to supply that growing demand for gold and copper.

And their share price will rise accordingly.

Right now, they’re only trading at about $4 a share.

But this is severely undervalued in my opinion.

Because get this:

Right now, they’re valued at roughly $305 million.

But in 2021, they had $314 million in free cash flow.

Just their free cash flow alone is higher than their current valuation.

Which means they should already be trading above $4.

By how much?

Well, based on how the industry typically values gold mining companies…

Buy factoring in their total revenues, their cash flow, and their earnings per share…

This company should be valued 10X higher than it is.

And the share price should be at least double what it is now.

Why is it trading so low?

The major thing holding this stock back has been permitting issues with the Turkish government for one of its mines.

But those shouldn’t be hard to solve – it just takes time to wade through the bureaucracy.

And once that’s done, I expect this stock to take off…

Handing an easy double, exposure to the metals market, plus consistent dividend payouts to investors who get in now.

But don’t listen to me.

Listen to the big institutional players who can see what’s coming.

Goldman Sachs just bought over 7 million shares.

JP Morgan is in for over $10 million worth of shares.

And Van Eck Associates just backed up the truck to the tune of 25 million shares…worth a whopping $175 million.

If anyone knows how hard the coming years are going to be, you can bet it’s the Wall Street elites.

And if they’re putting their money into gold or gold stocks, you probably want to be as well.

On a long enough timeline, history has proven that the price of gold only goes up.

Especially during hard times, in my opinion you need exposure to gold,

And if the approaching energy crisis or the runaway inflation hasn’t yet convinced you that hard times are coming, well, maybe this will:

The U.S. dollar is about to undergo a massive system shock unlike anything that’s ever happened before in history.

And it will pour rocket fuel on the energy crisis and inflation.

I call it the “Petrodollar Crisis.”

You may have heard of the petrodollar before.

When the petrodollar was created in the 1970s, it was one of the most brilliant strokes of foreign policy in history.

With one move, the United States GUARANTEED that the dollar would remain the world reserve currency.

Basically, if a country wants to buy oil, they can’t pay for it in Yen, Francs, or Rupees.

They have to pay for it in USD.

If a country doesn’t have USD, they have no oil.

If they have no oil, they have no country.

By requiring that USD be used to trade the global oil markets, the United States guaranteed an ever-increasing demand for the dollar.

All of a sudden, America didn’t have to worry about inflation.

Washington could print otherworldly sums of money to finance everything from the military to welfare programs.

And no matter how much money was printed, as long as global markets were expanding, and oil demand was growing…

Foreign countries would vacuum up as many dollars as they could…

And inflation could be kept in check.

The only problem is, the dollar depends on global oil prices being denominated in USD.

Which is why we ousted Saddam and Qaddafi when they threatened to establish a second petrocurrency-exchange system.

Because:

If the petrodollar collapses, the "permission slip" we've used for five decades to print so many extra dollars will be gone.

When that happens, the supply of USD will far exceed the demand for USD.

In other words, hyperinflation.

We’ve been able to maintain the petrodollar world order for over fifty years.

But even as we speak, it’s starting to crack.

The BRICS nations -– Brazil, Russia, India, China, and South Africa – have been hard at work setting up a system of oil exchange that is not dependent on USD.

And just a recently, the President of BRICS announced that it was complete.

If Russia and China are able to truly break away from the petrodollar, and establish a secondary reserve currency…

Well, it will lead to economic destruction on the level of the Great Depression…

Maybe even worse.

Because over the last two years, the Fed has printed more than 80% of all the dollars that have ever been in existence.

Think about that for a moment.

It was the most irresponsible central bank move in history.

And it’s already caused inflation to spiral so high, that the Fed has to put us into a recession just to tamp it down a little bit.

But:

If countries can trade oil in something other than the dollar, then whatever inflation we’re experiencing now will just be child’s play.

We’re talking about Weimar Republic level hyperinflation.

That was the period in Germany following World War I, when inflation got so bad that children were literally playing with blocks of useless cash like Lego bricks.

And it won’t take much.

If only say 25% of all oil transactions are settled in something other than the dollar, that’s going to cause our entire financial system to go into a tailspin.

We’re talking about Weimar Republic level hyperinflation.

That’s why Brian Deese, a former Blackrock executive and now-adviser in the Biden administration said that high gas prices are worth it.

He said that the Russia/Ukraine war is about "The future of the liberal world order."

Because the entire liberal world order depends on the petrodollar.

And our leaders want to bleed Russia dry and depose Putin before he can destroy the petrodollar.

But I think it’s too late.

The shift is coming.

Isolating Russia from the SWIFT system, jettisoning them from the entire global financial system has only quickened the transition.

Russia and China don’t want to be dependent on the USD to pay for the lifeblood of their economies anymore.

Neither does India.

Together, India and China account for 36% of the world population.

And Russia is the third largest producer of oil in the world.

They have all the resources and trade capacity to dethrone the petrodollar.

And they’ve already created the infrastructure to do it.

Over the next 12 months, the transition away from the petrodollar will speed up.

What will be the real-world effects of that on America?

Like I mentioned, hyperinflation will likely strike hard.

Remember Weimar Republic Germany?

Inflation got so bad there that a loaf of bread eventually cost the equivalent of $2 billion.

I’m not joking.

Now, I don’t think it will get that bad in America.

But I predict that we will see breadlines again, a sight no American has witnessed since the Great Depression.

People will lose their houses…

Entire families will collapse under the economic strain.

And the recent crime wave will get much worse.

Just look at what’s happened to our cities over the past two years of economic turmoil.

Progressive district attorneys are unleashing violent thugs on parole and they are terrorizing our streets…

Robbers are breaking into stores in broad daylight…

And homeless encampments are turning into multi-block shanty towns, filled with drugs, crime, and disease.

Robbers are breaking into stores in broad daylight…

And homeless encampments are turning into multi-block shanty towns, filled with drugs, crime, and disease.

In one Los Angeles homeless camp, they literally have bubonic plague.

And once hyperinflation sets in, the show will really start.

If you’re not working with your neighbors to create a neighborhood protection plan, it’s time to start.

Because as people get more desperate, they’ll do anything…to anyone.

And you don’t want to become a victim.

Now, that’s for your physical safety.

But what about your economic safety?

How can you weather the economic firestorm that will occur when the petrodollar collapses?

The truth is, I believe there will be few safe assets to turn to.

However, there is one.

Let’s go back to Germany in 1920s, when inflation was arguably the worst it’s ever been in modern history.

You know which group did the best?

Farmers.

Because they owned land.

Now, if you can’t go out and buy land for yourself and your family, that’s okay.

Because there’s a way to get exposure to farmland in your portfolio with the click of a button.

It’s called a Real Estate Investment Trust or REIT for short.

REITs are publicly-traded companies that own and operate commercial real estate.

There’s REITs for pretty much every type of property, from warehouses, to data centers, to hospitals, shopping centers, and most importantly for us, farmland.

By purchasing shares of a farmland REIT, you can get exposure to the most valuable asset in human history without getting your hands dirty.

And here’s the kicker:

REITs are legally required to pay out 90% of their profits to their shareholders in the form of dividends.

So, if you buy share in a REIT, you’ll be cashing monthly or quarterly checks just like you would if you’re a landlord.

I believe Great American Reset stock #3 is the best farmland REIT out there.

They own over 161,000 acres of farmland across the U.S. worth $1.1 billion.

Their farms produce everything from soybeans and corn, to avocados and citrus.

Which means they’re perfectly positioned for the tough road ahead.

Just over the last year, the price of corn has doubled.

The price of soybeans are up nearly 50%.

And the Russia-Ukraine War, Pakistani floods, a historic drought in our own country, and supply chain disruptions are just going to push the price of food even higher.

And the more expensive food becomes, the more valuable productive farmland will become too.

In 2022 alone, the price of U.S. farmland has jumped by 14%.

Which means this REIT has been making money hand over fist.

In just the first half of 2022, revenues are up 1,164%.

And remember, 90% of all revenue has to be passed to you and other shareholders.

Which is why Great American Reset Stock #3 is one of the best investments you can use to weather the coming hyperinflation.

If and when the petrodollar collapses, food prices will soar.

Just imagine paying $50 for a loaf of bread.

Or $30 for a carton of eggs.

Now, I hope to God this doesn’t happen.

That our leaders come up with some ingenious way to avoid hyperinflation.

But look at them.

Biden can barely talk.

The diversity hires at his cabinet are more interested in weird gender and race grievances than actual policy…

And everyone else seems to have very, very strange connections to China.

So, no one is coming to save you.

You have to take control of your portfolio.

Investing in farmland has never been a bad idea.

Not in all of human history.

And it isn’t a bad idea now.

It could even be the difference between you lining up at the breadlines…

Or being able to put food on the table for your family.

Because we are heading towards unprecedented chaos.

This may sound dramatic, but I’m not exaggerating.

Decades of fiscal, policy, and leadership mismanagement have put us on the course for disaster.

And it’s time to pay the piper.

But like I mentioned at the very beginning of this, America will emerge out the other side.

Most likely for the better.

But it will be one heck of a ride to get there.

And it’s up to you as an investor to decide whether you sit back and do nothing or try to grow richer during all this turbulence.

And the three stocks I’ve showed you today – the LNG exporter helping keep the lights on American energy…

The gold and copper miner that can help you avoid the devaluation of our fiat currency with their precious metals…

And the farmland REIT that will allow you to profit from farmland – the most valuable and stable asset ever created—as the petrodollar collapses and hyperinflation sets in…

These three stocks can be your shield during the upheaval that’s hitting us.

And they are the cornerstone investments of a new, special investment research package I’ve created.

I call it The Great American Reset Survival Plan

I’ve designed it to be the most comprehensive wealth protection package in the world.

The three stocks I’ve showed you today – the LNG exporter, the gold and copper miner, and the farmland REIT – are the cornerstone investments of the plan.

But they are not by any means, the only potentially wealth-saving measures I’ll show you.

For instance, most people have no idea that when the financial system is melting down…

One of the best investments you can make is actually in the eye of the storm.

I’m talking about banks.

Now, I don’t mean the big boys, like JP Morgan or Wells Fargo.

I’m talking about the small, independent banks.

There are 4,612 community banks in the U.S.

You’ve probably never heard about any of them.

But these small banks routinely outperform the S&P 500.

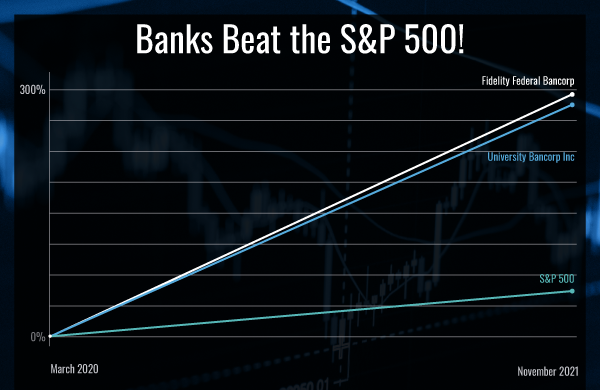

For instance, just look at Fidelity Federal Bancorp.

They only have an $11 million market cap.

And they only operate about 20 branches in Indiana.

Yet between June 2018 and August 2022, Fidelity Federal returned a whopping 280% to investors!

Or look what happened to University Bancorp Inc.

Between March 2020 and November 2021, their share price rose from $6.10 to $22.

A 260% return!

And these are only two examples – there are dozens more banks that handed investors similar crazy returns on their money.

Far better than the S&P did.

Look at this:

Over the same period, between March 2020 and November 2021, the S&P only returned 48%.

In other words, these banks stocks performed 5X better.

But that’s just one reason why I love bank stocks.

Because even while their share price is shooting up…

These banks will also be putting fat wads of cash in your pocket month after month.

Think about it:

What is the Fed doing right now?

They’re raising interest rates.

And when interest rates go up, banks make more money.

And because the vast majority of these small banks pay out massive dividends to their shareholders….

More money for banks means more money for you!

One bank – Santa Cruz County Bank – has increased its dividend from $0.02 a share in 2017…all the way to $0.13 a share now.

That’s a 550% increase!

Imagine if you were making $5,000 a year in dividend income from them in 2017.

Now you would be cashing more than $32,500!

In just five short years!

And here’s the kicker:

Over the last 10 years, Santa Cruz County Bank shares have jumped 380%.

Almost doubling the return of the S&P.

If you don’t love banks after everything I’m showing you, you’re going to.

Because as part The Great American Reset Survival Plan, I’m including a special report called Bank Bucks: How to Profit From the Eye of the Storm.

In this report, I'm going to reveal three banks that I

believe are the perfect mix of growth plus dividends. The

first bank has increased its cash flows 65% over the last

twelve months. So, they’re flush with cash to hand out to

their shareholders.

And they’re raising their dividends faster than ever before.

In September alone, they raised their dividend by 10%...

Bumping it up from $0.19 a share to $0.21.

Imagine you were making $20,000/yr in dividends off this bank..

And then, you get a 10% raise.

You’ve added another $2k to your bottom line.

Without doing a single thing!

And the best part is, inflation is at 8% -- at least, according to the government.

So, a 10% dividend increase means you’re beating inflation!

And I think we’ll see many more dividend raises over the next year.

Because this bank is using its strong cash position to snap up competitors.

It just announced a MAJOR acquisition…the latest in a three-year long streak of buyouts.

I wouldn’t be surprised if a year from now, their dividend has jumped by 20% or even 30%...

Putting more and more cash income into your pocket each time.

In Bank Bucks, I’ll give you a complete rundown of this bank, where they operate, their financials, and of course, their ticker symbol so you can get in now.

I’ll also hand you two other banks that are well-capitalized, paying out fat dividends, and that I believe are set to grow as The Great American Reset unfolds.

One of the most important things about these banks is that they are American.

We’ve been living with globalization ever since World War II.

But with Russia, China, India realigning themselves with each other, away from the West…

With the petrodollar set to lose its hegemony over global oil markets…

We’re heading towards a much more fragmented world.

It’s going to be a world where we can’t just export our entire manufacturing chain to a cheap third world country.

On the other end of the Great American Reset we will see a new era of “America First” investments.

Companies that are in America, run by Americans, and for America.

And there’s no better example of this than chip manufacturing.

COVID showed us just how fragile our supply chains were.

The semiconductor chips that are so critical for literally every piece of technology in our lives, from our airplanes, to our cars, to our phones, computers, heck, even our baby diapers…

88% of all those chips are made in another country.

Which means we don’t control them.

And during COVID there was a massive chip shortage.

Which had ramifications for our entire economy.

It’s one of the reasons why cars became so expensive – because there weren’t enough chips to make them.

Well, to make sure that never happens again, Congress just passed the CHIPS Act.

It authorizes $52 billion to be spent building up America’s own domestic semiconductor industry.

And there’s one company that I believe will be at the center of all those billions of dollars.

This is a potential 1,000% gain opportunity – at least.

It could end up being much more than that.

Just look at Taiwan Semiconductor.

It handed investors peak gains of 4,901%.

And Samsung – another big manufacturer from South Korea –handed investors a 3,900% gain.

America is the second largest importer of semiconductors – behind Hong Kong.

We import $2.5 billion worth of semiconductor chips every year.

Mainly from Taiwan Semiconductor and Samsung.

But with the passage of the CHIPS Act, a good portion of that money is going to stay right here, in America…

And likely flow to this one company.

In the first half of 2022, they made just $56 million dollars in revenue.

So, let’s say they land at $100 million for the year.

If they can capture just a quarter of the $2.5 billion America is spending to import chips…

That’s a 600% increase in their revenues!

But here’s where it gets even better:

The CHIPS Act mandates that our chip production needs to flow to 100% American-owned companies.

Yet the chip companies you’ve probably heard of, like NVIDIA, Intel, or AMD, either a) design their chips, then outsource production to foreign companies or b) like Intel, they only design chips for their own devices.

But the company I’m telling you about?

They’re the only 100% U.S. owned chip manufacturer in the country who both designs and manufactures their chips for American companies.

Which means there is literally no competition.

They’re the only company that can fulfill the mandate of the CHIPS Act right now.

And chip demand is not slowing down.

McKinsey estimates that it will become a $1 trillion market by 2030.

Right now, it’s at $613 billion.

You do the math.

It could end up being much more than that.

Just look at Taiwan Semiconductor.

It handed investors peak gains of 4,901%.

And Samsung – another big manufacturer from South Korea –handed investors a 3,900% gain.

America is the second largest importer of semiconductors – behind Hong Kong.

We import $2.5 billion worth of semiconductor chips every year.

Mainly from Taiwan Semiconductor and Samsung.

But with the passage of the CHIPS Act, a good portion of that money is going to stay right here, in America…

And likely flow to this one company.

In the first half of 2022, they made just $56 million dollars in revenue.

So, let’s say they land at $100 million for the year.

If they can capture just a quarter of the $2.5 billion America is spending to import chips…

That’s a 600% increase in their revenues!

But here’s where it gets even better:

The CHIPS Act mandates that our chip production needs to flow to 100% American-owned companies.

Yet the chip companies you’ve probably heard of, like NVIDIA, Intel, or AMD, either a) design their chips, then outsource production to foreign companies or b) like Intel, they only design chips for their own devices.

But the company I’m telling you about?

They’re the only 100% U.S. owned chip manufacturer in the country who both designs and manufactures their chips for American companies.

Which means there is literally no competition.

They’re the only company that can fulfill the mandate of the CHIPS Act right now.

And chip demand is not slowing down.

McKinsey estimates that it will become a $1 trillion market by 2030.

Right now, it’s at $613 billion.

You do the math.

If this company captures just 1 percent of that market -- $10 billion – that’s a revenue increase of 17,757%!

That’s equivalent to turning a $2,500 stake into $446,425.

Now, the share price probably won’t rise that high..

But are you starting to see why I believe a 1,000% gain is a conservative estimate?

This could be the stock that gains the most all through The Great American Reset…

And long afterwards as well.

Which is why I want to show you how to get into it yesterday.

All the details are in another special report I’ve created called Make Chips Great Again: How to Profit from the End of Globalization…

And it’s included in The Great American Reset Survival Plan.

This package is exactly what I’m using to protect myself from The Great American Reset.

All you have to do to get it is join my elite investment research service called Stealth Trades.

You see, the Reset is going to take years to play out.

And you’re going to need someone there, on your side, helping to guide you through it.

This is where Stealth Trades comes in.

Who do you think is going to do best during The Great American Reset?

I’ll give you a hint:

It’s the people who always do the best.

The big money players, the institutional traders, the banks, and the hedge funds.

These are powerful people who simply possess information you don’t.

And no matter what happens to the economy, the Wall Street players are going to do just fine.

Stealth Trades will allow you to see exactly how these major institutions are trading..

And give you the chance to copy their trades.

Each week, I’ll send you three brand new “smart money” trades.

You’ll get to see exactly where the most powerful hedge Wall Street institutions are putting their money during The Great American Reset.

And you’ll be able to trade right alongside them.

Each week, I’ll be there, showing you how to potentially avoid financial ruin and grow wealthier during the chaos that’s coming.

So, just to recap, when you join Stealth Trades today. you're going to get the entire Great American Reset Survival Plan.

The Great American Reset Survival Plan

So, just to recap, when you join Stealth Trades today, you’re going to get the entire Great American Reset Survival Plan.

That includes the three stocks that I’ve talked about today.

Great American Reset: Stock #1: The LNG exporter that will soon be supplying all of Europe with natural gas and potentially doubling its share price in the process.

Great American Reset Stock #2: The gold and copper miner that could give you potential 10X returns.

Great American Reset Stock #3: The Farmland REIT that will allow you to cash regular dividend checks from the most inflation-resistant asset in the world: Farmland.

You’ll also get:

Bonus Report #1: Bank Bucks: How to Profit From the Eye of the Storm.

Bonus Report #2: Make Chips Great Again: How to Profit from the End of Globalization

And each week, you’ll get three new trade ideas.

These are the trades that Wall Street institutions are making in order to protect their own wealth from the Great American Reset.

We’re living through the Reset as we speak.

Which is why it’s critical that you act as soon as possible.

To get you started as quickly as possible, I’m authorizing a special discount for those people who join Stealth Trades today.

You’ll be able to become a member for 72% OFF the regular price.

But to get that discount, you have to join right now.

There’s an ancient Chinese curse that goes: “May you live in interesting times.”

And boy are the times interesting.

Which is why it’s so critical that you become a member of Stealth Trades right now.

And learn how to save yourself and your family from the Great American Reset.

This special 75% discount won’t last forever

So, join now.

Click here to be taken to the secure checkout page.

To your wealth,

Ross Givens

THIS MATERIAL IS OFFERED FOR EDUCATIONAL AND GENERAL INFORMATIONAL PURPOSES ONLY. NO INVESTMENT ADVICE IS OFFERED.

This is an advertisement for online information courses, workshops, classes and other educational programs relating to finance and investing. It is not an advertisement for investment advice. Neither Traders Agency, LLC nor its principals or affiliates are registered investment, legal, or tax advisors or broker/dealers. All content, materials and information found in any product or service that Traders™ Agency offers and that you have access to or consume must be understood by you to be for educational and general informational purposes only.

The information provided to you by Traders™ Agency is general and impersonal in nature and does not take into account your individual investment objectives, financial situations, risk tolerances, or needs. Before implementing or using any information provided to you by Traders™ Agency and before making any financial or investment decision, you must confirm the accuracy of such information and applicability and appropriateness of any decision to your personal situation with your own analysis or by consultation with a licensed/registered and qualified investment professional.

While Traders Agency, LLC works hard to ensure that the content, materials and information we provide is up to date, we cannot and do not guarantee its accuracy or completeness. Additionally, unintended errors and misprints may occur. Any commentary, analysis, opinions, recommendations, or other statements herein represent the personal and subjective views of Traders Agency, LLC and our affiliates and are subject to change at any time without notice. The content, materials and information provided by Traders Agency, LLC is obtained from sources that Traders Agency, LLC believes to be reliable. However, Traders Agency, LLC does not independently verify or investigate all such information, and therefore you must and with your registered/licensed financial advisor conduct your own verification and investigation of content, materials, and information provided by Traders Agency, LLC. Neither Traders Agency, LLC nor any of its affiliates guarantees the accuracy or completeness of such content, materials or information. To the maximum extent permitted by law, Traders Agency, LLC disclaims any and all liability in the event any information, commentary, analysis, opinion, or recommendation proves to be inaccurate, incomplete, unreliable, or results in you having any kind of investment or other losses.

Traders Agency LLC intends that the information contained in this advertisement is truthful and not misleading in any way. Accordingly, you are fully informed that none of the information, material, or courses that Traders Agency, LLC offers constitute investment advice and all such information is provided for educational and informational purposes only.

INVESTING INVOLVES SUBSTANTIAL RISKS, INCLUDING THE POSSIBLE LOSS OF PRINCIPAL. PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS. YOU ARE RESPONSIBLE FOR PERFORMING YOUR OWN ANALYSIS OR CONSULTING WITH YOUR PERSONAL LICENSED/REGISTERED ADVISORS BEFORE MAKING ANY INVESTMENT DECISION.

Privacy Policy | Terms & Conditions | Risk Disclaimer | TCPA