Former Investment Bank Vice President:

“Throw Away Your Stock Charts”

Exposed: The shocking loophole this ex-Wall Street executive used to nab gains as high as 1,787% on stocks ordinary investors wouldn’t touch…

PLUS the 3 hottest stocks he’s tracking right now…

Dear Reader,

My name is Ross Givens, and I want you to take a look at this:

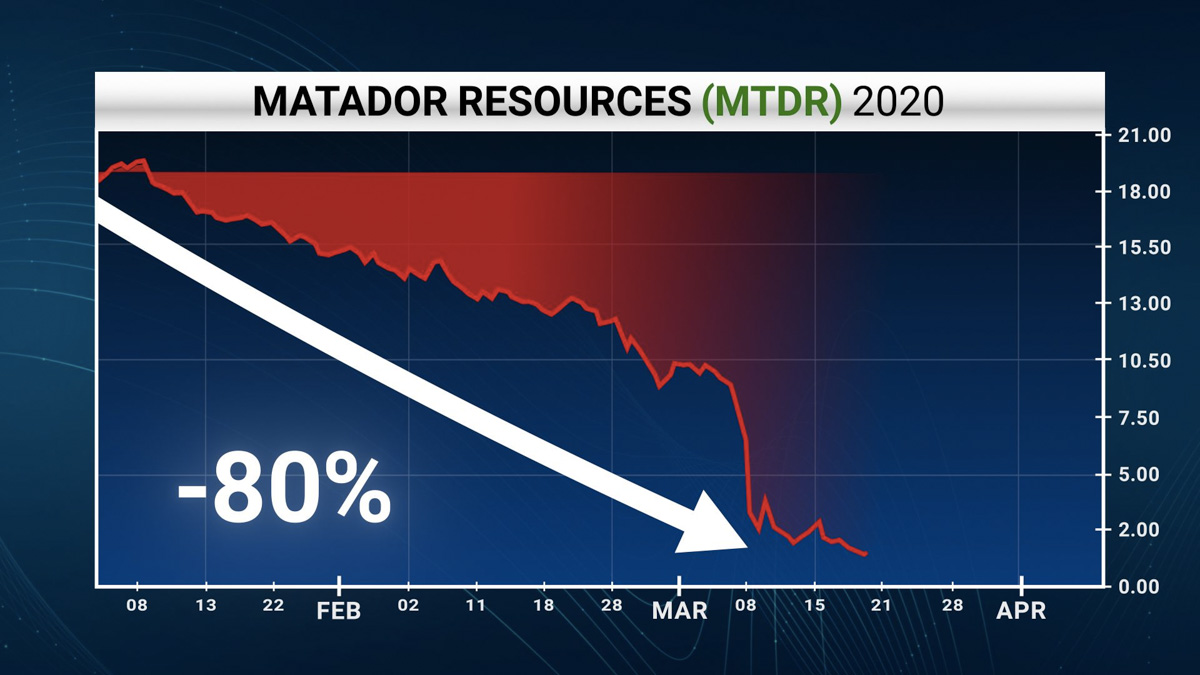

It’s a stock chart of Matador Resources when I first alerted my members to it.

Ugly, right?

We bought this stock in April 2020, when it traded for just $3.59 a share.

By June 2022, Matador was worth $67 a share… a gain of 1,787%.

That’s enough to turn every $5,000 into $94,350…

Or $10,000 into $188,700…

In just 26 months.

According to the stock chart…

The company’s fundamentals…

The overall market conditions…

And just about every other indicator that stock analysts and serious investors consider…

I shouldn't have touched this stock with a ten-foot pole.

In fact, if it weren’t for one secretive stock market loophole that I’ll show you today, my members and I would have missed this opportunity entirely.

It’s a legal loophole that 99% of Americans have no clue about…

A loophole I’ve been using for years to uncover explosive stock wins.

Stocks like Matador, which we still own today…

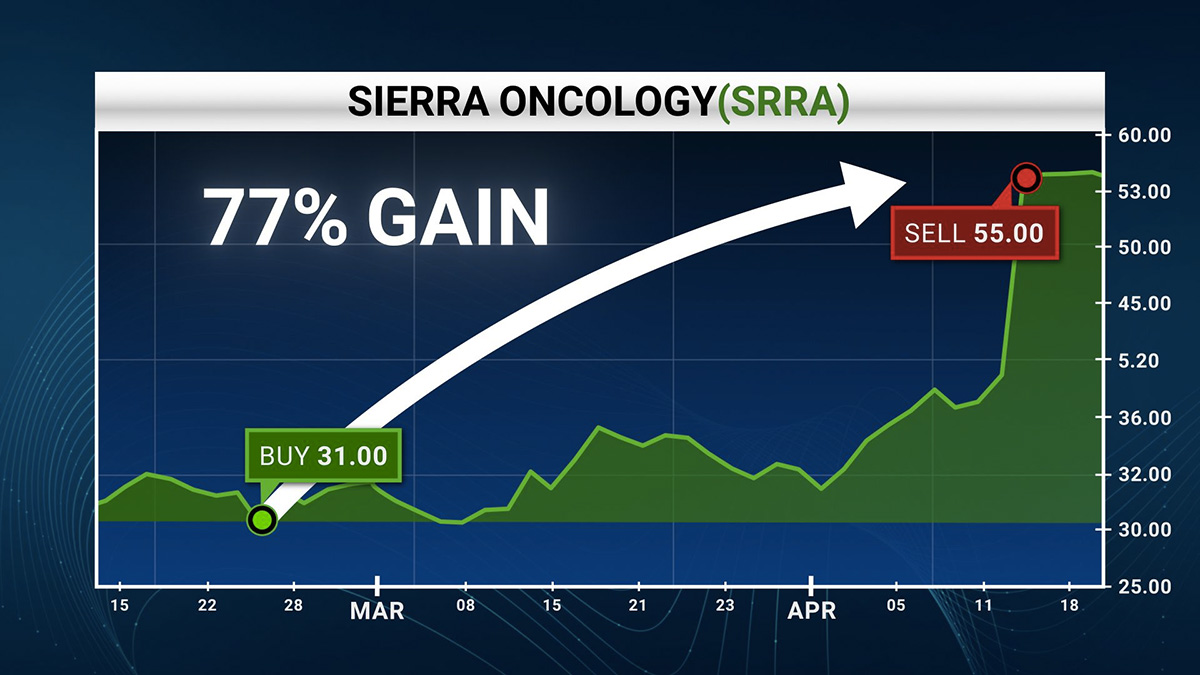

SRRA that handed my members an 81% gain in 8 weeks…

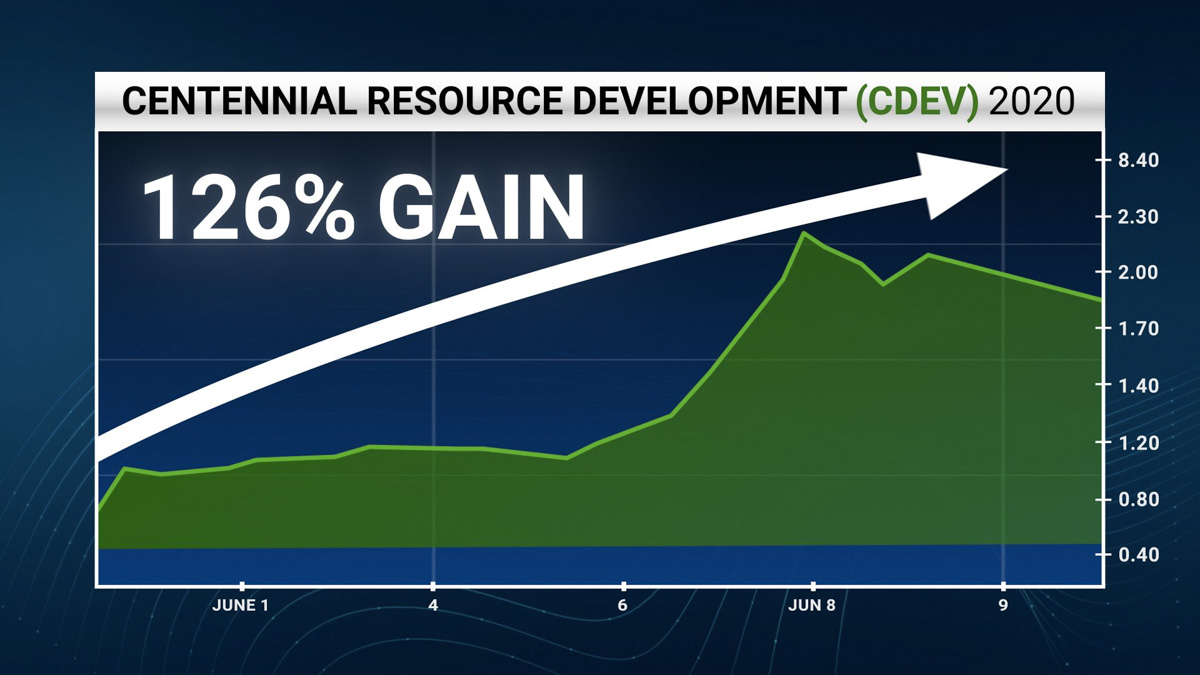

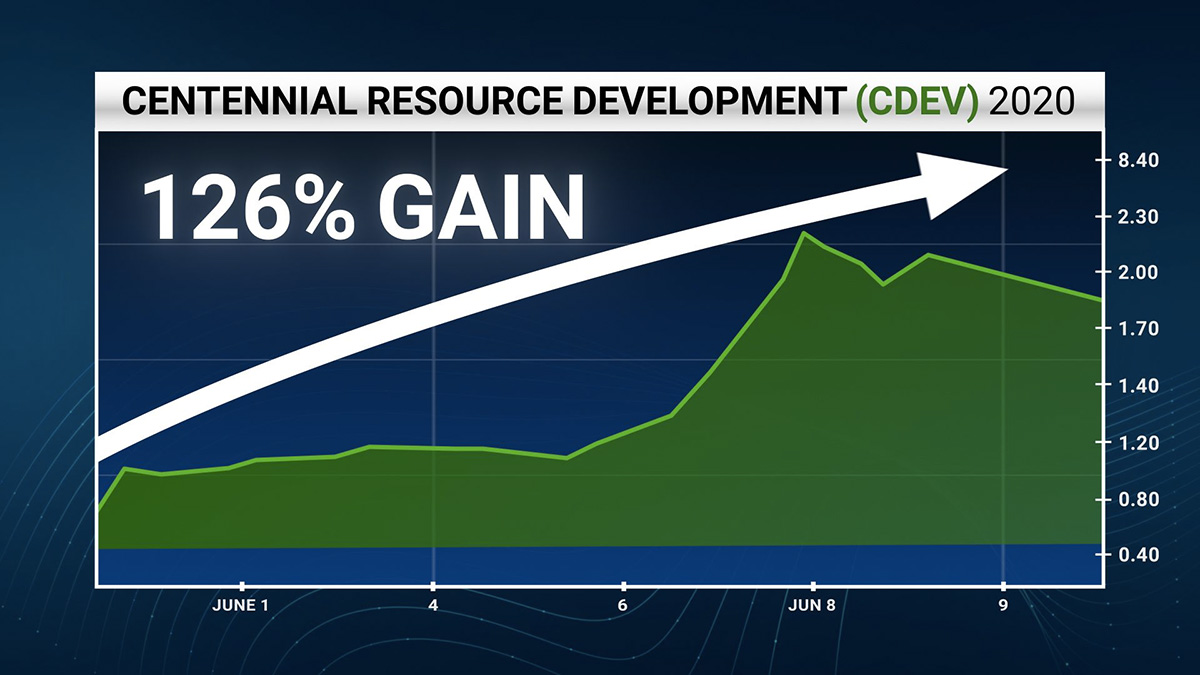

And CDEV that gave us 126% in 10 days.

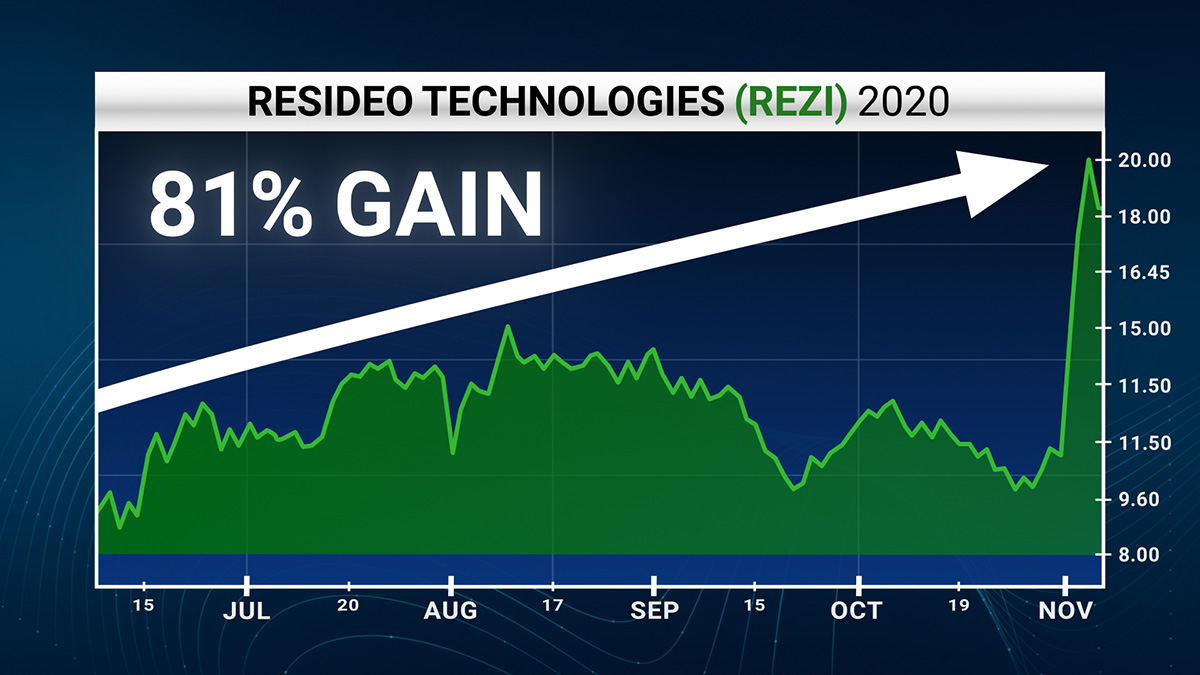

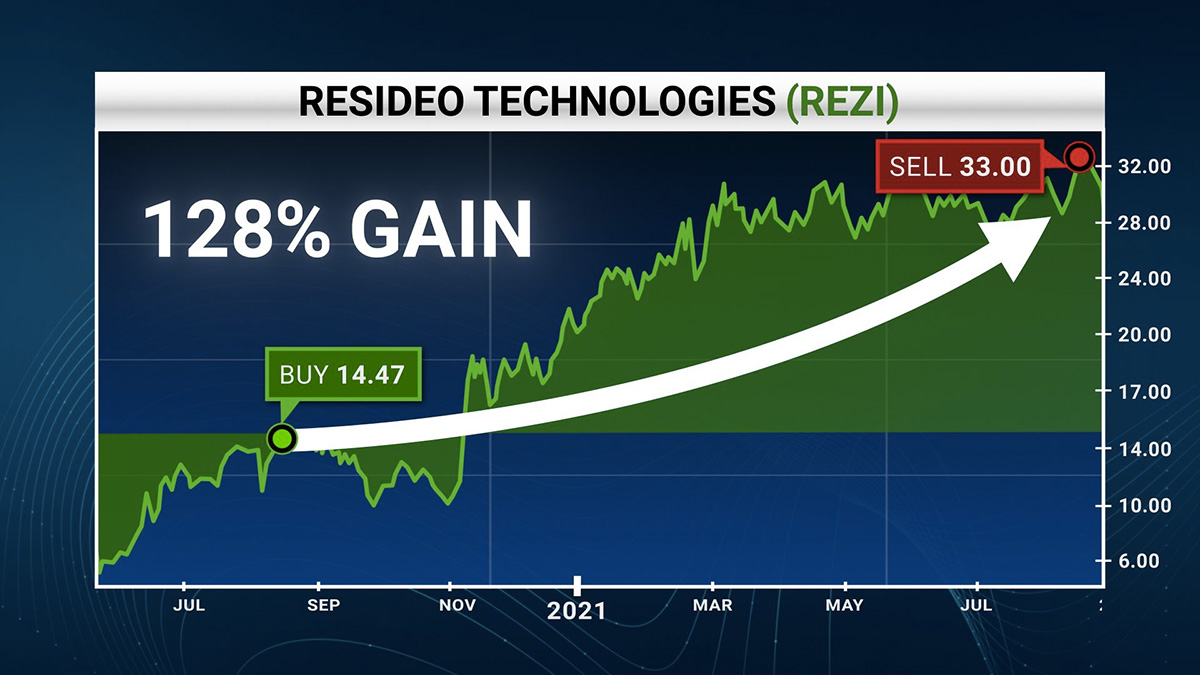

This loophole was also responsible for our 81% win in 5 months on REZI…

106% in 3 months on LQDT…

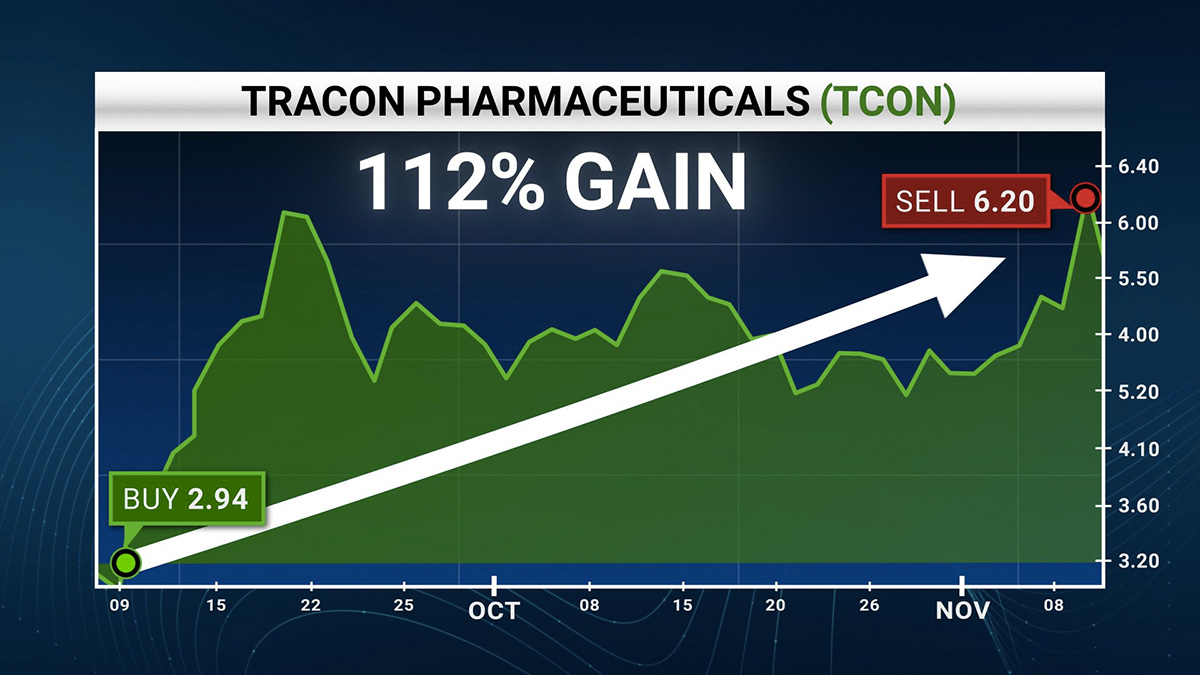

112% in 8 weeks on TCON…

… and dozens of others.

This loophole has helped us DEMOLISH the track records of Wall Street legends, including Warren Buffett…

Peter Lynch…

George Soros…

And even Nancy Pelosi, one of the nation’s most notorious insiders.

Over the next few minutes, I’m going to show you exactly what this loophole is…

How it works…

And how you can start using it immediately.

I’m even going to share the details of THREE stocks I’m tracking right now…

And how you can get your hands on them TODAY…

Before they potentially erupt with profits.

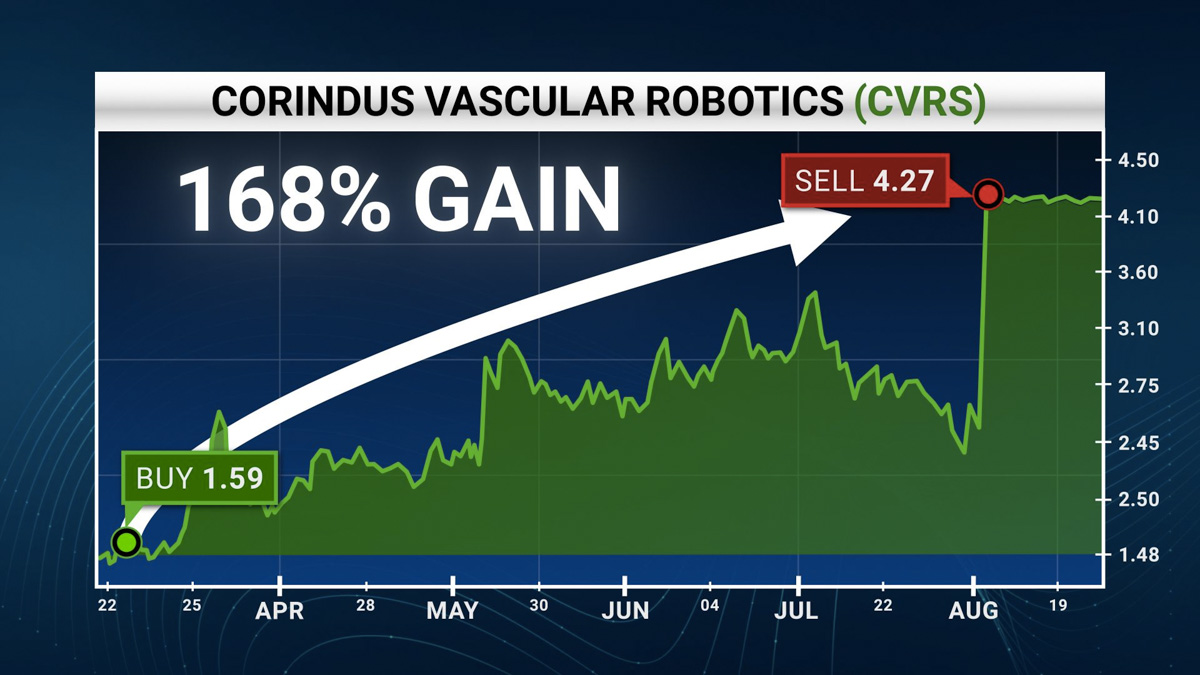

I’m talking about stocks like Corindus Vascular Robotics, ticker symbol CVRS.

I used this little-known loophole to alert my members to buy CVRS when it was trading for just $1.59.

It jumped 58% in just 4 days!

Five months later, the stock was up to $4.27…

Handing us a hefty 168% gain.

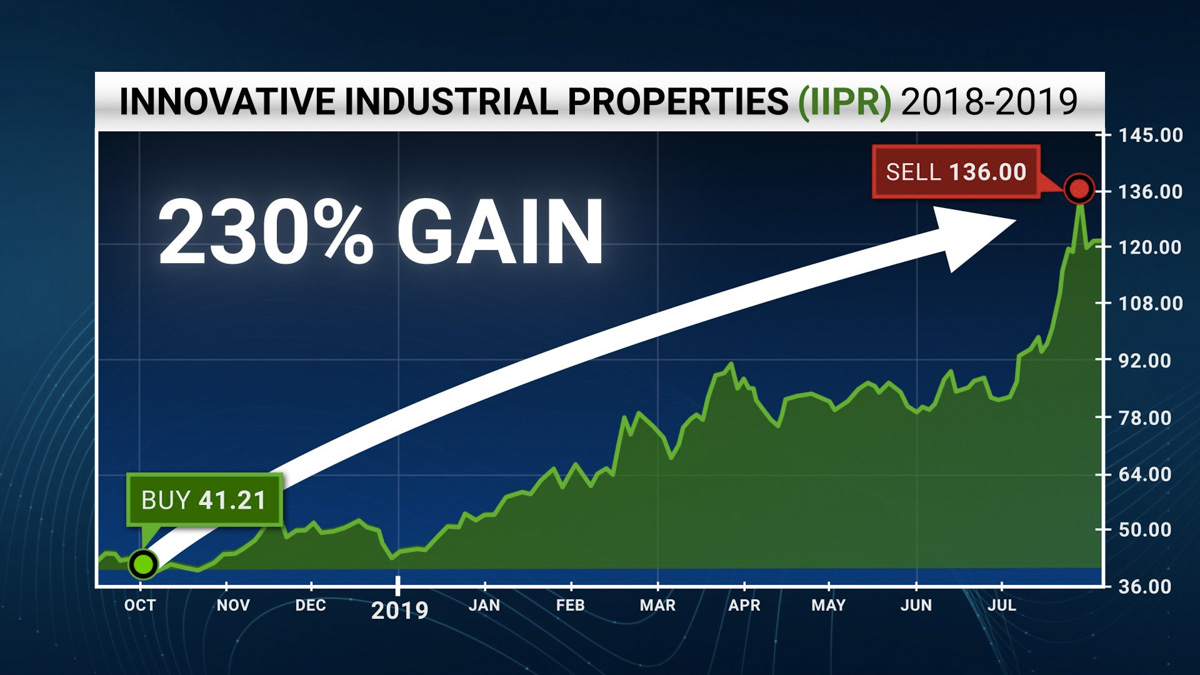

Then there was Innovative Industrial Properties.

This loophole tipped me off to this stock in late 2018…

And on October 22nd, I sent readers my official buy alert.

The stock went on to gain 230% over the next 8 months:

That’s a trade that turns every $5,000 into $16,500…

More than TRIPLE your money.

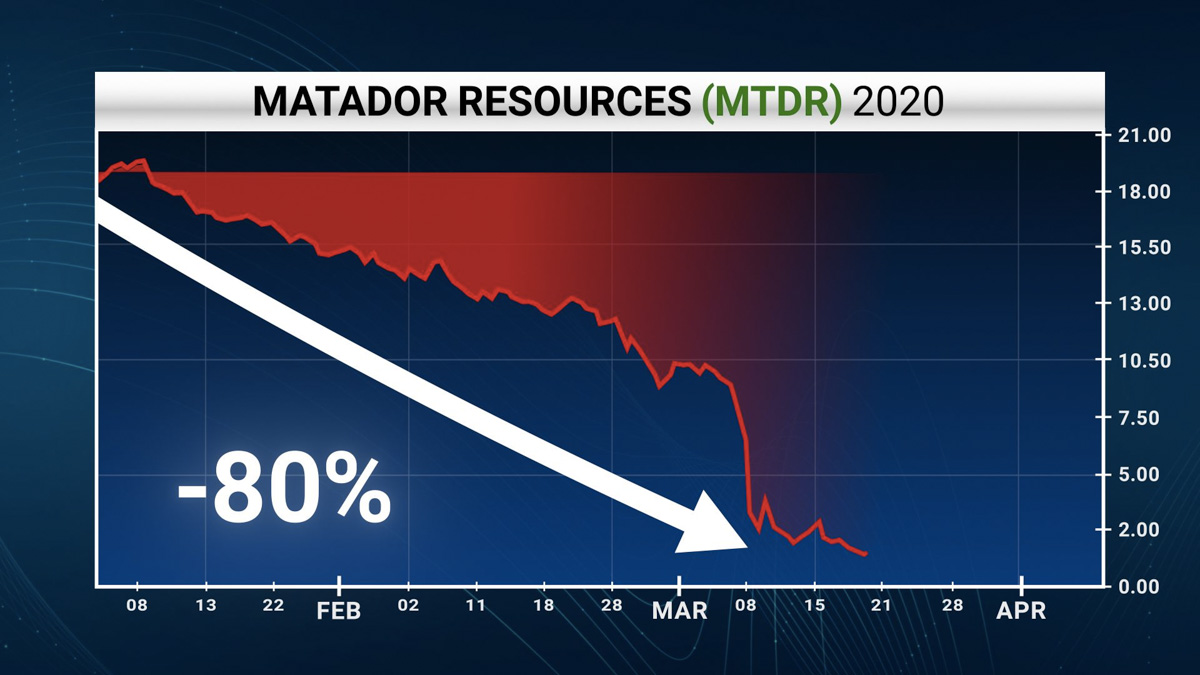

And, of course, there was Matador Resources.

This stock went up big, and it went up FAST.

Within 3 weeks of my official buy alert, Matador’s stock increased 155%...

Enough to turn every $5,000 into $12,750:

But it was just getting warmed up.

By June 2022, just two years after I called this stock a buy at $3.59 a share…

Matador hit a peak of $67.76.

And here's the craziest part...

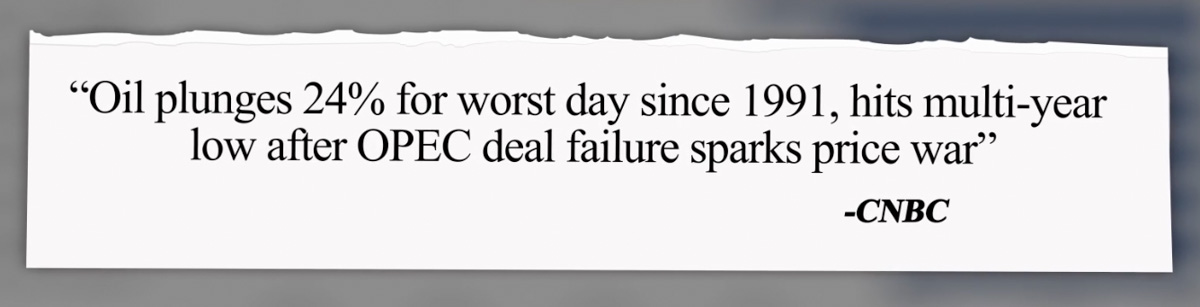

Matador Resources is an oil company.

I officially called Matador a buy on April 9, 2020…

When almost the entire country was under lockdown orders.

No one was driving anywhere…

And oil demand fell off a cliff.

Crude prices plunged from over $60 a barrel in January to below $20 in March:

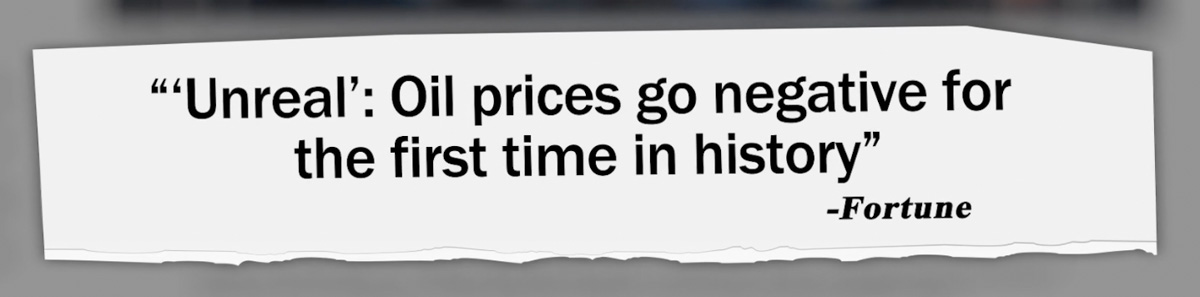

For the first time ever, the price of crude went NEGATIVE…

That means distributors were actually paying people to take oil off their hands!

It was one of the worst times for oil stocks in the history of the market.

You saw the chart.…

Matador looked as good as dead.

MTDR stock had fallen more than 80% over the past 3 months!

Look, I’ve been in this business a long time.

I know hundreds of traders.

And I don’t know one chart reader between here and Rhode Island that would have recommended buying this stock at this time.

But guess what?

I wasn’t looking at the stock chart.

I didn’t need to…

Because I knew something about Matador that virtually no other regular investor knew.

It’s like Michael Douglas said in the original Wall Street movie…

“The most valuable commodity I know of is information”...

And information is EXACTLY what this loophole lets us in on.

More specifically…

Inside information.

Don’t freak out. This is perfectly legal.

I’ll explain all that in just a second…

But I want you to really stop and think about this for a moment.

Why do you think Nancy and Paul Pelosi have gotten so much attention over the last few years for their “amazingly accurate” stock-picking ability?

They’ve been making insanely profitable stock moves for close to two decades…

And those moves have been landing the Pelosis in the headlines for just as long.

Of course, the Pelosis aren’t the only political power couple making a killing in the stock market.

Our representatives in DC make MILLIONS trading stocks each year.

These people sit on the committees that oversee every commercial industry in the nation.

They write the laws that regulate every publicly-traded American company.

They have daily access to the most sensitive, market-moving information ahead of virtually everyone else on the planet.

At this point, it’s like they’re not even trying to hide it!

I mean, just imagine if you had daily access to top-secret intelligence…

Breaking events like a global pandemic…

And other market-moving information long before 99% of the population ever knew a thing.

What kind of advantage would that give you in the stock market?

Well guess what?

That’s EXACTLY what the elites in DC have!

Like Representative Don Beyer.

He traded technology stocks like Microsoft and Alphabet while sitting on a congressional committee that oversees those very companies.

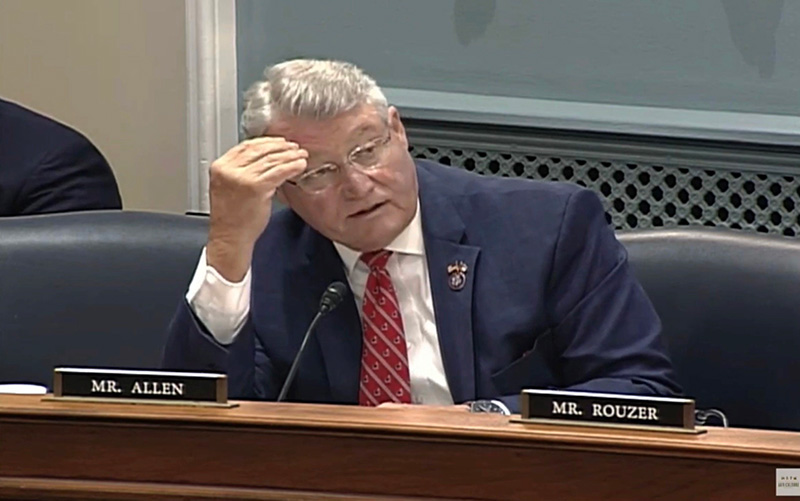

Then there’s Representative Rick Allen…

Who traded pharmaceutical companies like Johnson & Johnson and Merck while sitting on a subcommittee that was considering prescription drug price legislation.

And Congresswoman Katherine Clark, who influences funding for the U.S. Department of Health and Human Services while her husband trades health care companies that receive government contracts.

How do we know about all this?

Well, we DIDN’T know about it…

Until AFTER these politicians stuffed their pockets full of thick wads of cash…

And some reporters started doing some digging.

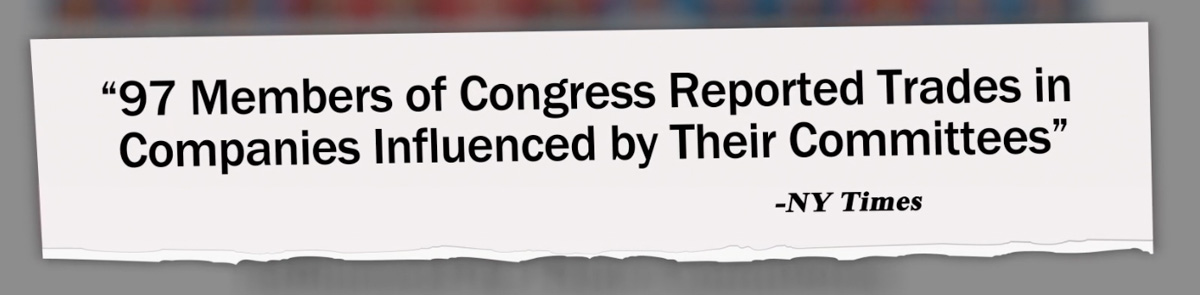

Take a look at this bombshell report from The New York Times:

Listen: You’re not stupid.

Neither am I.

There’s a reason one of the most popular trading trends going is “Pelosi tracking”!

It all comes down to one simple fact…

In the stock market, information is KING.

It’s the ultimate edge…

And in all my years of analyzing and trading stocks…

I’ve NEVER found a better way of getting information that can lead to exceptional stock wins than this loophole.

That’s because this loophole allows everyday Americans just like you and me to get...

Completely LEGAL access to explosive inside stock tips…

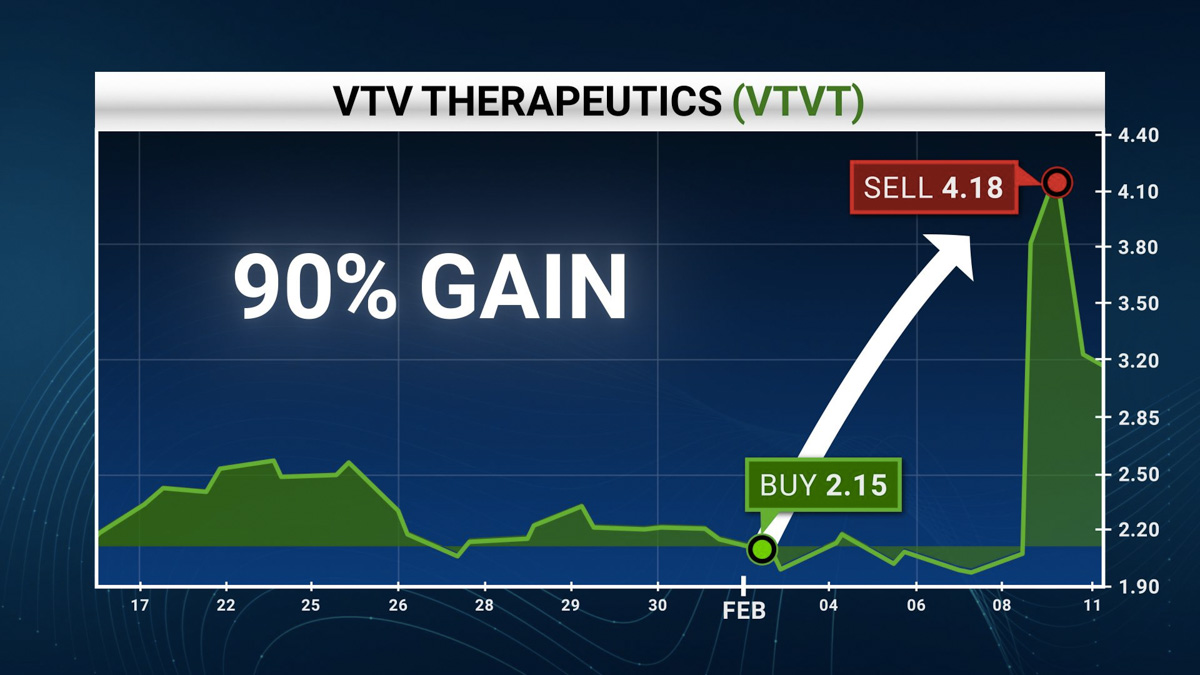

Just like the ones that led me and my readers to a 90% gain on VTVT stock in 24 days…

88% on TCON in 7 days…

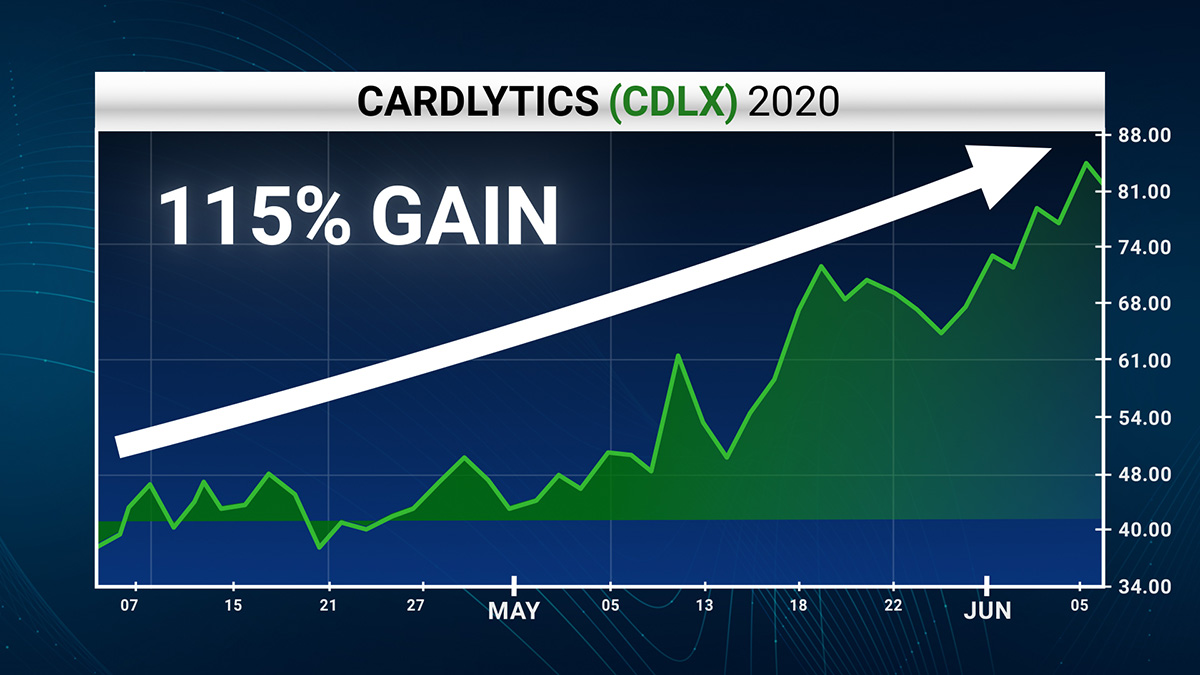

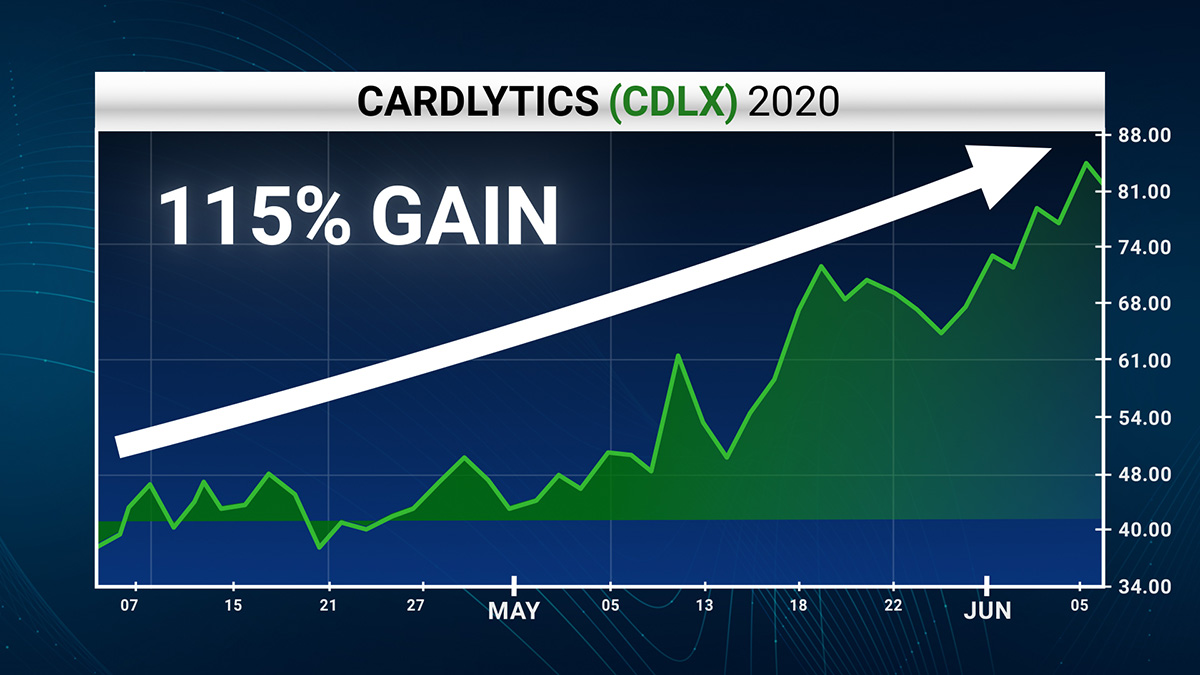

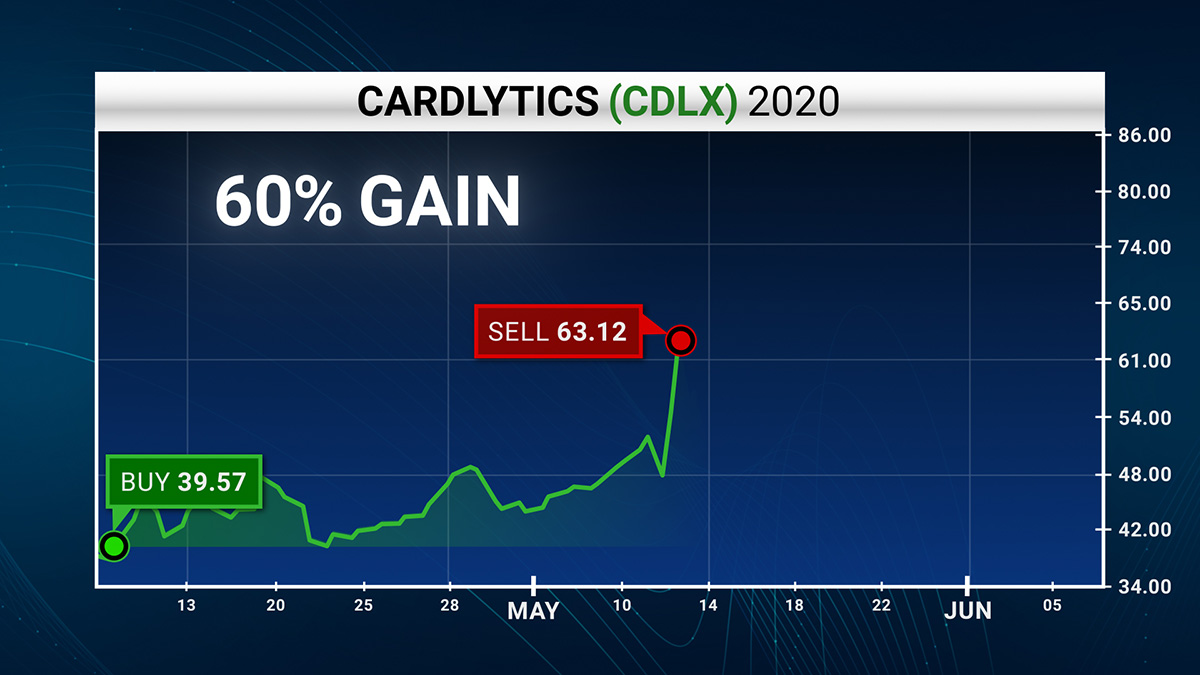

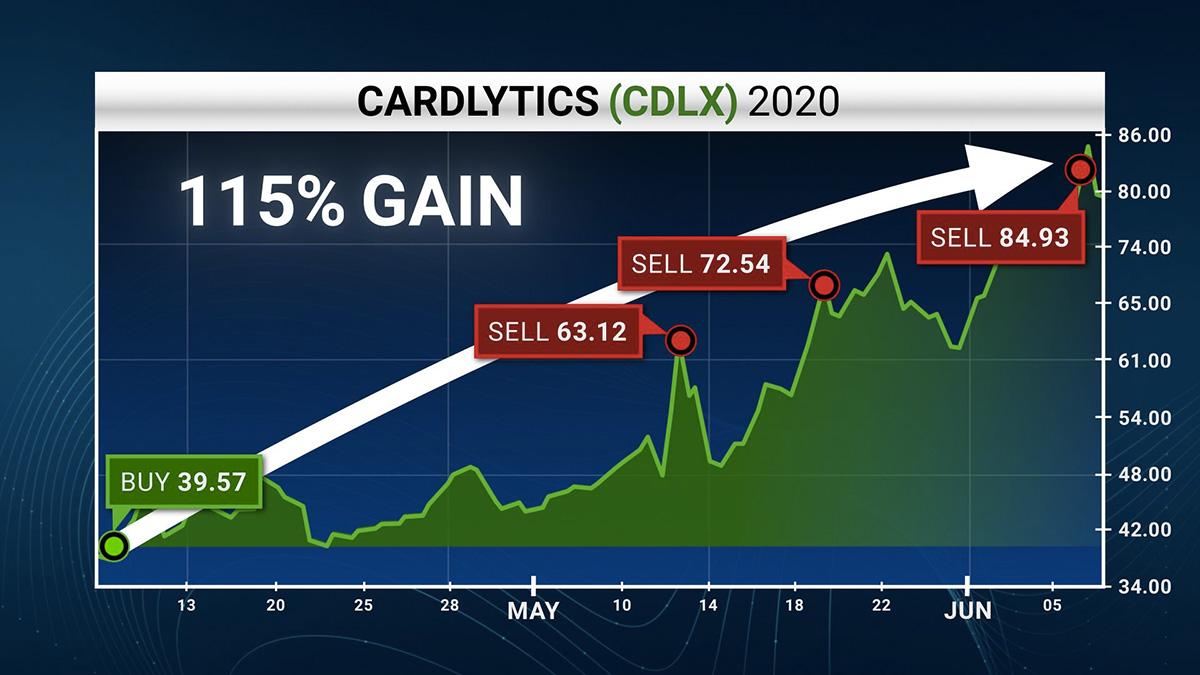

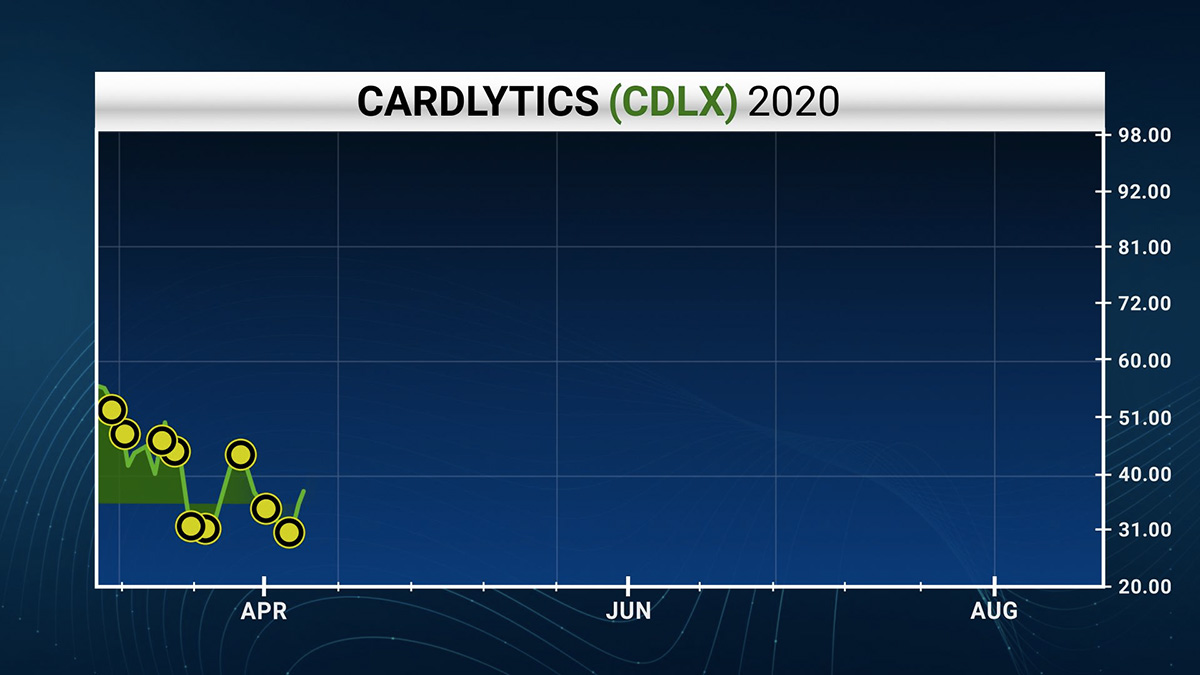

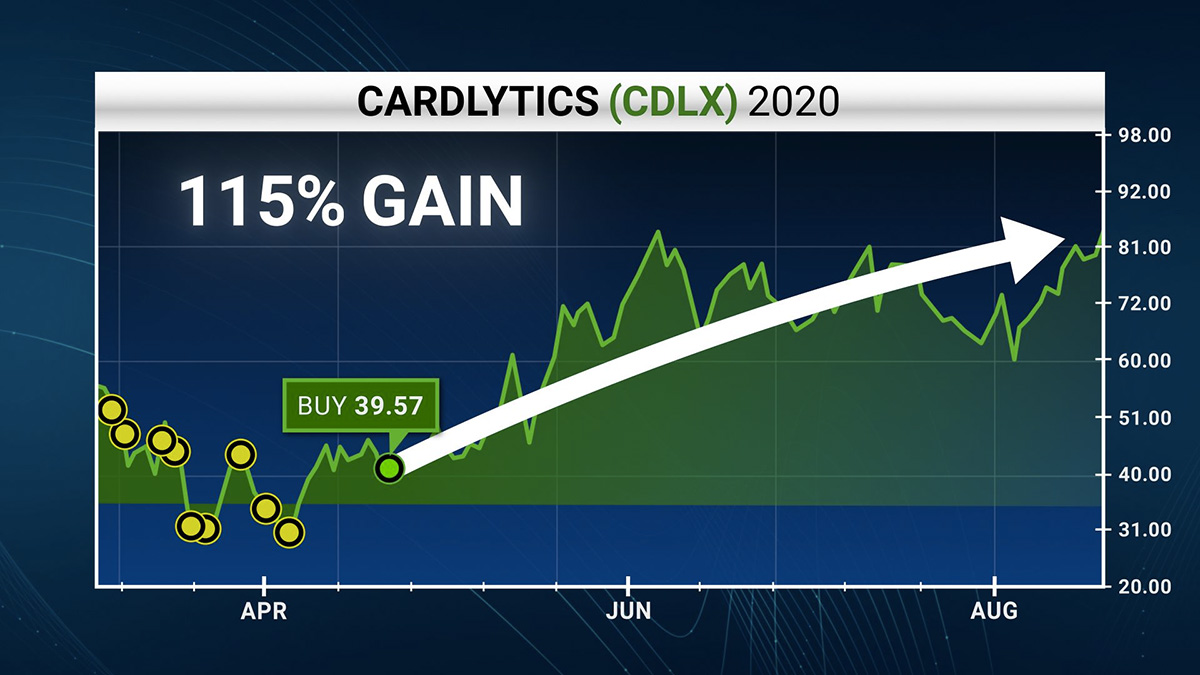

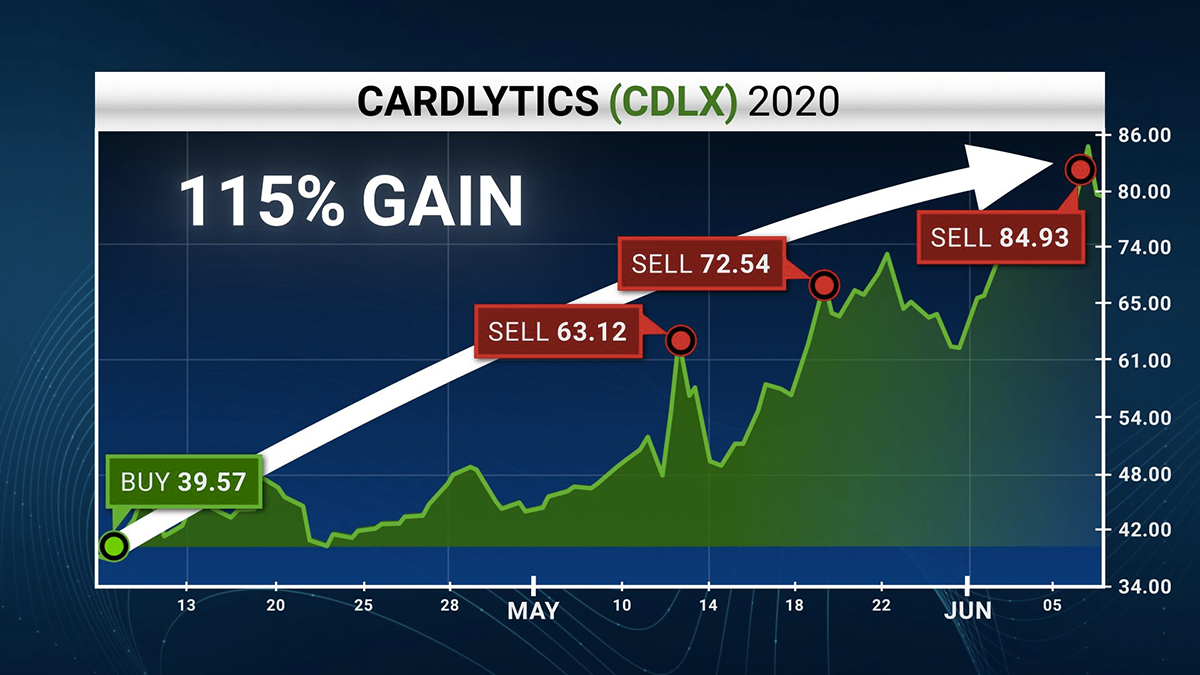

And a 115% gain on CDLX stock in less than 60 days.

And check this out:

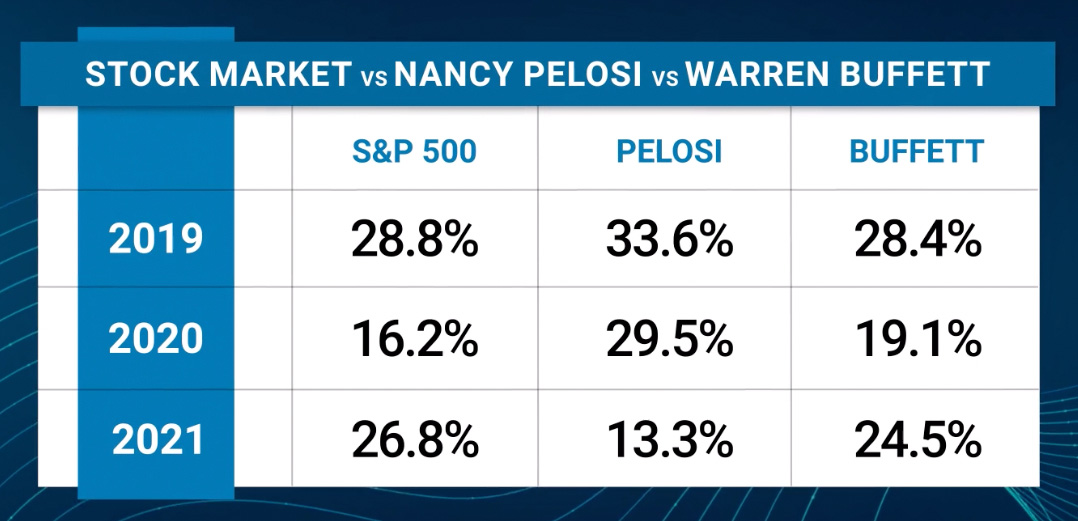

These are the annual returns of the S&P 500 against some of the most elite stock pickers on the planet:

That’s right — Pelosi actually outperformed Buffett by 10 percentage points in 2020!

For more context, Peter Lynch and George Soros are considered among the most successful investors of all time.

What kind of returns were they able to achieve?

Lynch generated an annualized 29.2% return for his legendary Magellan Fund…

And Soros produced a roughly 20% annual gain in his Quantum Fund.

Now take a look at this…

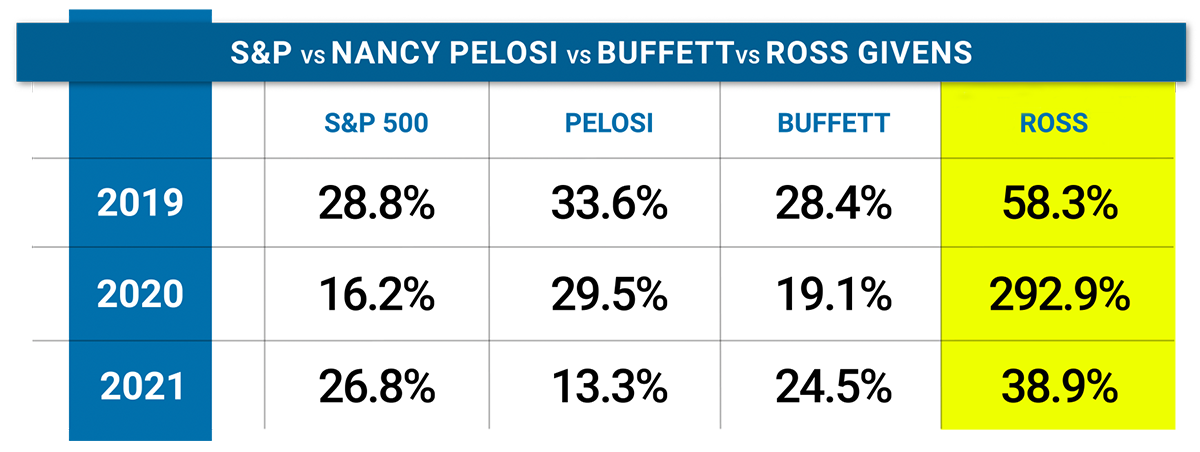

These are the annual returns I’ve generated for my members using this one legal loophole I’m about to show you:

In 2019, I more than DOUBLED Buffett’s numbers, returning 58% on the year for members who listened to me.

In 2021, I TRIPLED Pelosi’s performance and beat Buffett by nearly 15 percentage points.

And as for 2020?

I recorded a 292.9% annual return compared to Pelosi’s 29.5% and Buffett’s 19.1%.

That’s TEN TIMES the return of the ultimate Washington insider…

And more than FIFTEEN times Buffett’s annual gain.

Yes, those figures include wins AND losses…

And had you started with me in 2017 when I began making this research publicly available…

You could have grown a $100,000 account into $1.1 MILLION through the first half of 2022.

We’re talking a 5-year compounded return of 1,076.4%...

And that’s only counting the stock returns!

I’m not including what we made buying the call options on a lot of these stocks.

I don’t know of any other stock strategy that can help you get anywhere close to that kind of wealth-building potential.

So if you haven’t had the stock market “breakthrough” you’ve been looking for, don’t worry…

It’s not your fault.

Because the truth is, trading is hard!

Don’t let anyone fool you.

There is no “magic bullet” when it comes to buying and selling stocks.

If it was easy, everyone would be doing it…

And everyone would be making money.

But as Buffett famously said, “It’s only when the tide goes out that you learn who has been swimming naked”...

And the 2022 bear market proved him right.

And here’s another reality kick:

Bear markets…

Corrections…

Selloffs…

Even full-blown recessions…

It doesn’t matter.

The people who have the right information will make money every time.

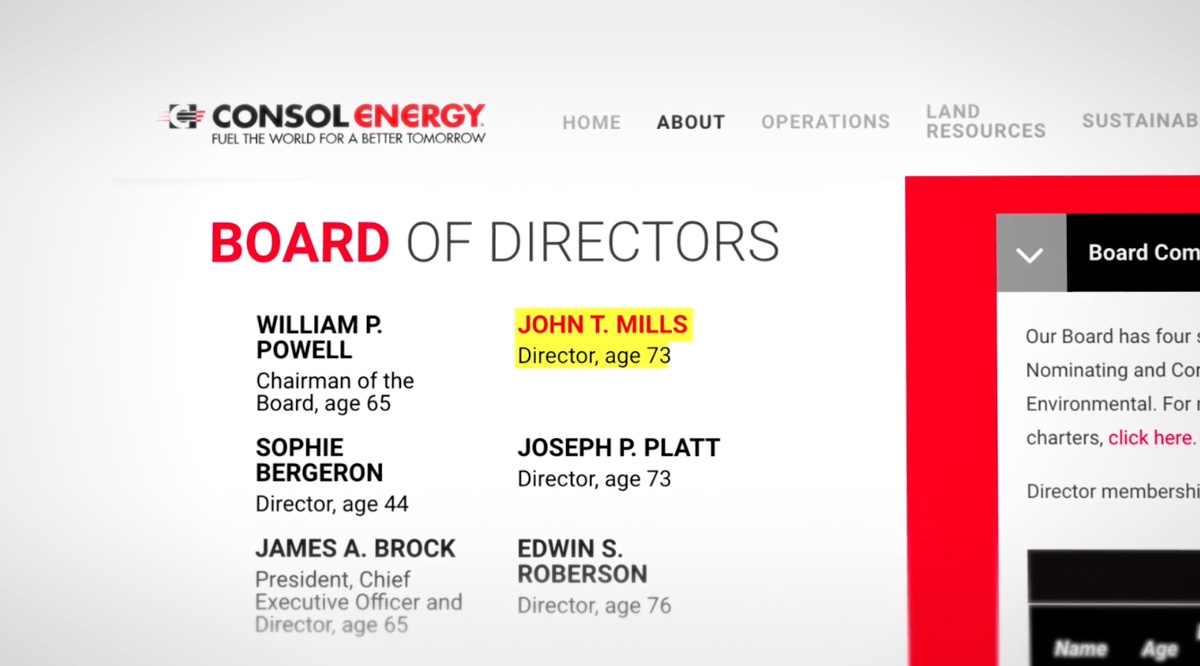

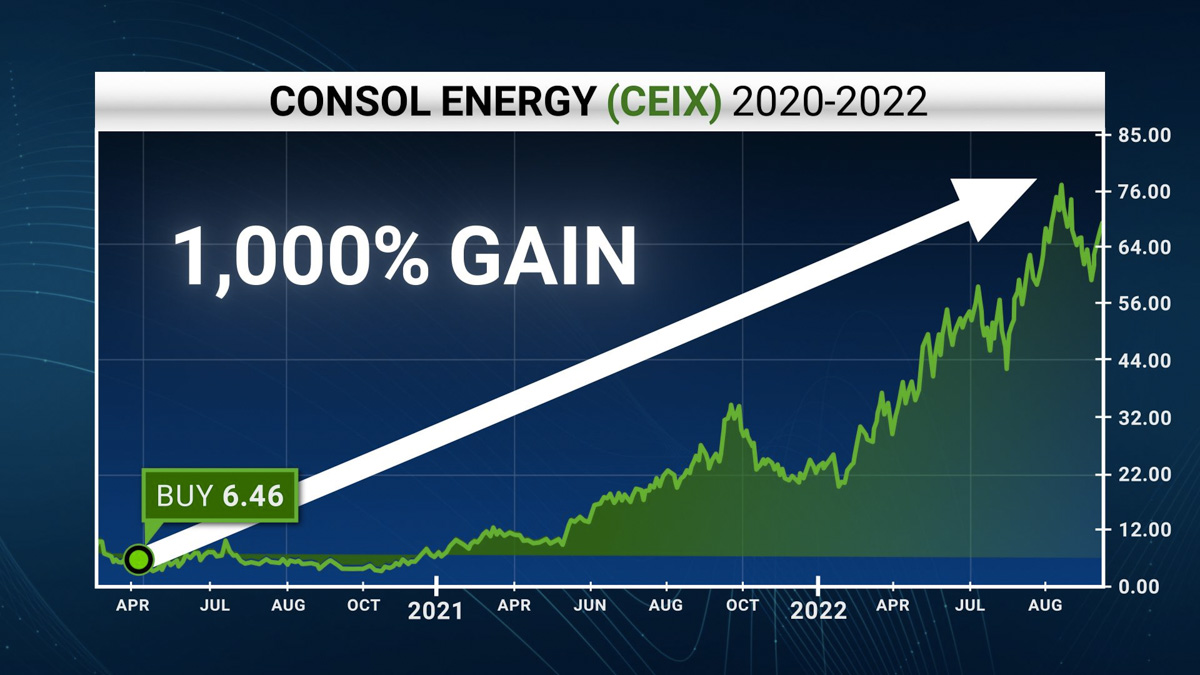

People like John Mills, who sits on the board of directors at CONSOL Energy, a coal mining company.

John quietly bought shares of CONSOL when they were trading for just $6.46 a piece back in early 2020, right before the Covid selloff.

Today the stock is up over 1,000%.

Or how about Robert Leasure, John Beattie and Beth Taylor…

The Chief Executive Officer, Chief Operating Officer and Chief Financial Officer of biotech firm Inotiv.

All three executives started scooping up Inotiv stock in early 2021.

Eight months later, the stock was up 256%.

Then there’s Gary Vogel, CEO of Eagle Bulk Shipping.

Gary began buying up shares in late 2020…

Right before shipping stocks made huge runs higher.

By June 2022 — in the middle of the worst bear market in a decade — his shares were up 330%.

So you can see why I say this loophole you’re about to discover has the potential to unlock the biggest, fastest stock wins of your life.

Now, that’s a hell of a statement.

So who am I to sit here and make such a claim?

My name is Ross Givens.

I bought my first stock when I was 12 years old, and managed to turn a $2,000 loan from my dad into $2,800 on Microsoft.

After high school, I went to Auburn University where I graduated with a degree in finance…

And at the time, the head football coach was a guy named Tommy Tuberville.

If the name sounds familiar, it should…

He’s now a U.S. Senator and one of DC’s most notorious stock traders.

After college I entered the world of institutional finance, and quickly began climbing the “corporate ladder.”

It wasn’t long before I was serving as a Vice President of Investment Management at a major investment bank, where I managed portfolios for high net worth clients.

I held Series 7, Series 66 and Series 3 securities licenses…

Served as a broker, financial advisor and a CTA fund manager…

I’ve been invited to just about all the major financial media outlets to share my views on the market, including CNBC, Fox Business, Bloomberg…

Stuart Varney and I had such a good time that he asked me back to his show close to a dozen times.

But working at a big Wall Street bank got old fast.

Frankly, it was BS.

Our bread and butter was putting clients in A-share mutual funds.

A-shares carry a 5.25% front-end load — a.k.a. commission.

So if you invest $100,000, you’re charged a $5,250 commission on day one.

On top of that, most of the funds underperform.

So you’re usually paying above-market commissions for below-market performance.

When I tried to build personalized stock portfolios for my clients, the compliance department wouldn’t let me. They said it was “too risky” for our customers.

The whole thing felt like a scam. And I didn’t feel my clients were getting what they deserved.

So I left.

I let all my fancy licenses expire, and teamed up with a financial publisher so I could make my research available to the average, everyday American investor…

And for the better part of the last decade, that’s all I’ve done.

These days, I’m happy to report that I’m married to the most incredible, smoking hot woman I have ever met…

We live in a beautiful house in Oak Grove…

Where we’re raising our kids with a set of values and common sense that seems to have gotten lost over the years.

But of all the things I’ve done in my financial career, I’m probably best known for being a leading expert in what I call insider buying…

And you’re about to see why.

Now, for the past few minutes I’ve been dancing around what I believe to be the most valuable stock market loophole in existence.

So let’s dive into it….

I’m sure I don’t have to tell you that insider trading — the act of trading a public company’s stock based on private information — is illegal.

At least, it’s illegal for you and me.

But here’s what 99% of people don’t know:

Under the rules of the U.S. Securities and Exchange Commission — better known as the SEC…

Corporate insiders are LEGALLY ALLOWED to trade their own stocks.

Let me say that again…

Corporate insiders — I’m talking about CEOs, CFOs, board members, vice presidents…

These people can buy and sell their own stocks 100% LEGALLY thanks to an obscure SEC rule.

Let me explain…

The SEC’s official insider trading policy states that insiders cannot trade on material, nonpublic information.

But as usual, there’s a loophole.

It’s called SEC Rule 10b5-1…

This “rule” essentially says that as long as insiders have a written plan for when they will buy and sell their company’s stock, they are free to do so.

But the rule is so vague, it’s laughable!

Because the “plan” for when the insider intends to buy and sell can be almost anything…

Even their own proprietary formula.

The SEC doesn't even require executives to disclose the plan’s existence, its provisions or any changes made to it.

The 10b5-1 plan, instead of being filed with the SEC, is simply set up with a brokerage firm.

It can be changed, modified or canceled at almost any time, for almost any reason.

So basically, the way I look at it…

The whole “rule” is just one, big nothing-burger.

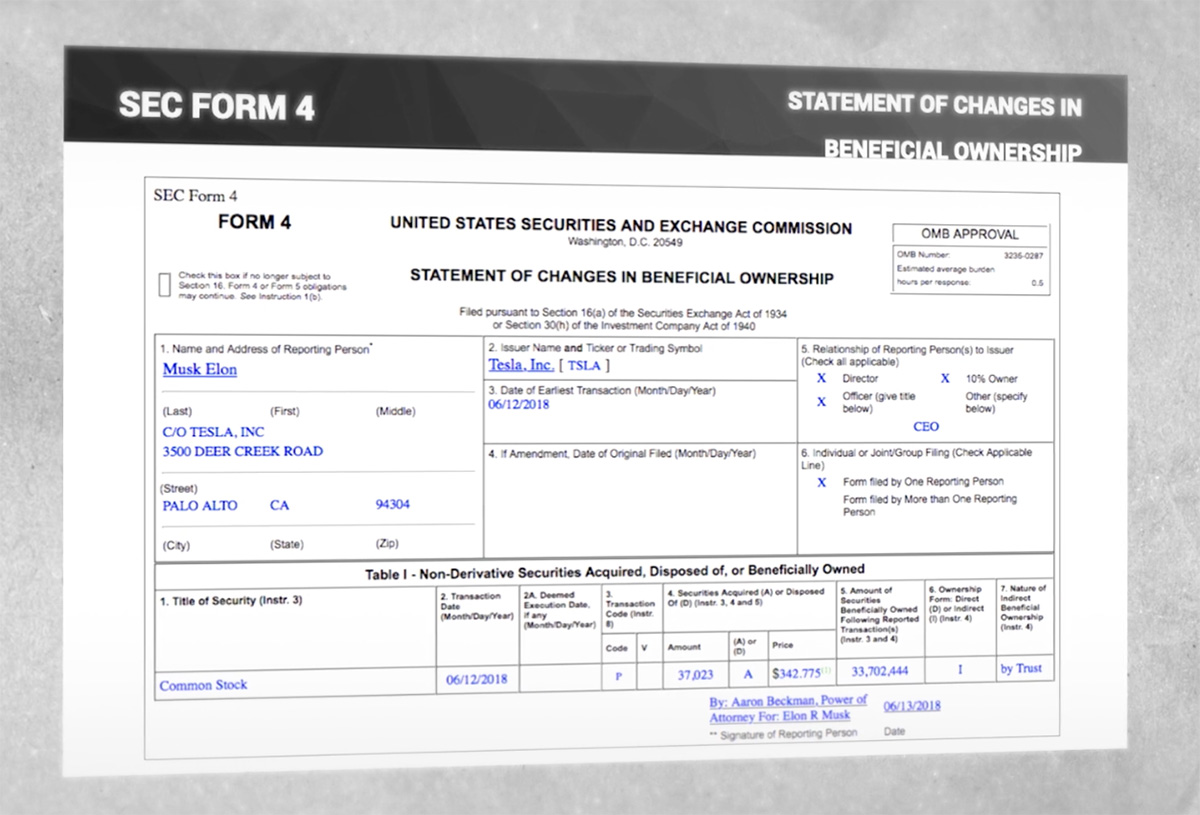

But there IS a reporting requirement that these insiders MUST follow.

They do this on what’s known as a Form 4.

It looks like this:

Insiders have to disclose how many shares they bought, at what price, and when.

These Form 4s are filed in a publicly-accessible database on the SEC’s own website.

That means…

ANYONE with internet access can see exactly when corporate insiders are buying up their own stock…

And follow their lead to potentially MASSIVE stock gains.

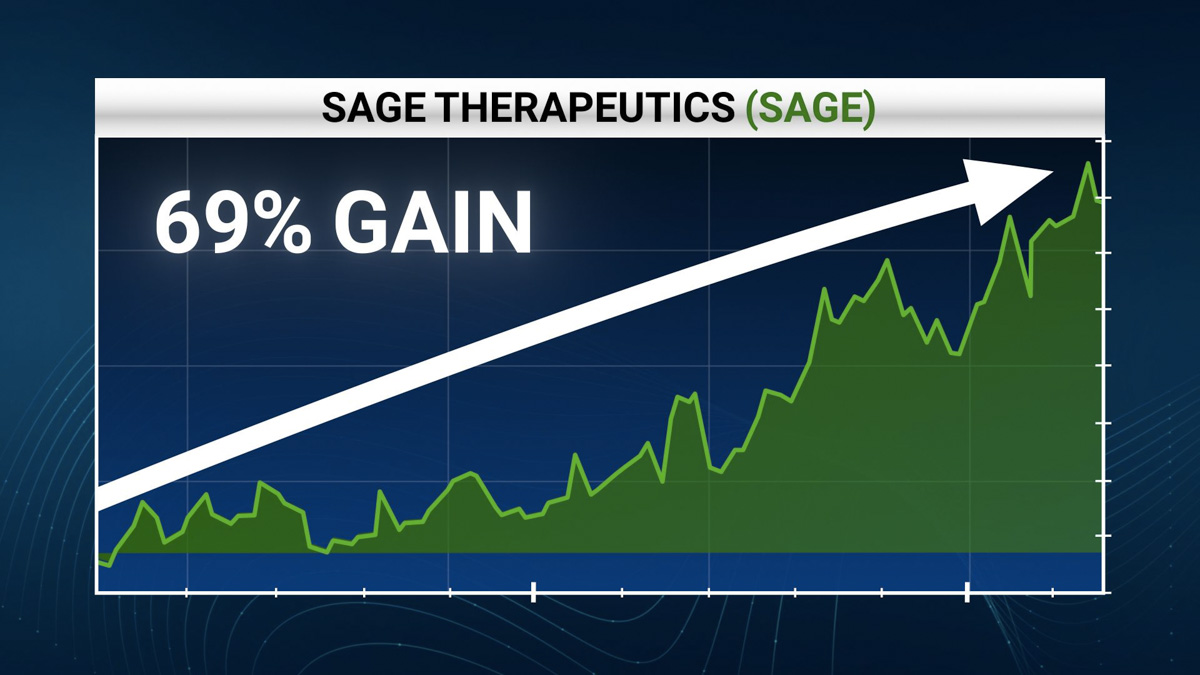

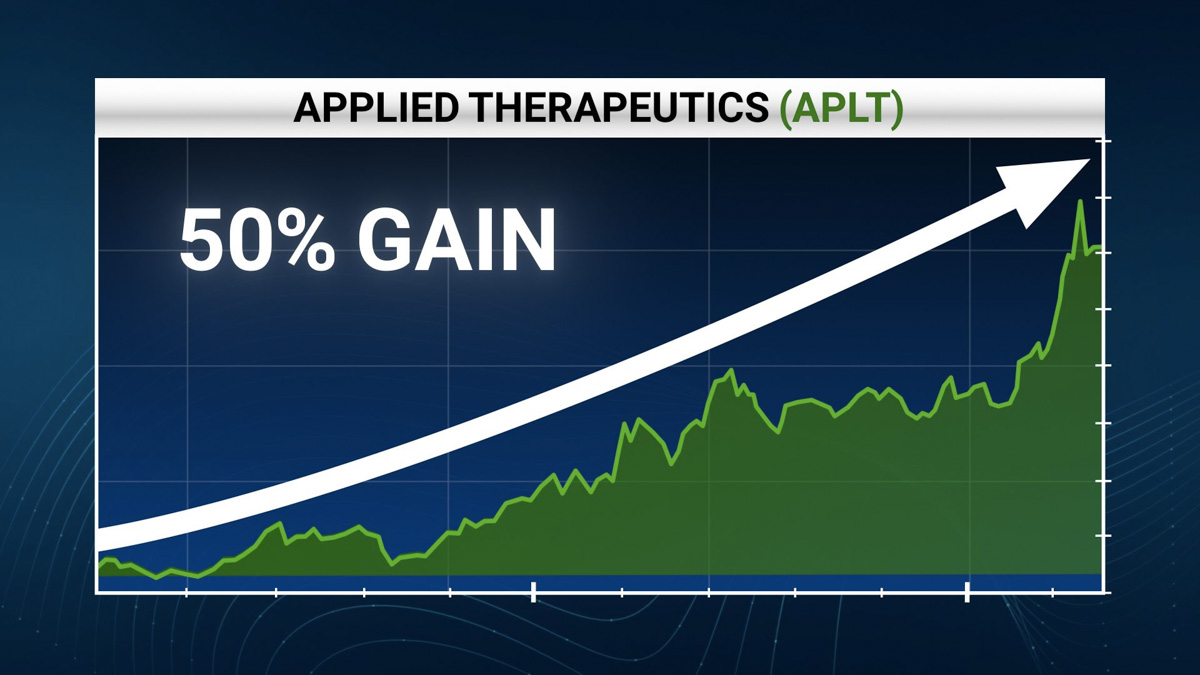

This is precisely how I was able to detect winning trades like a 69% gain on SAGE in roughly 6 weeks…

50% on APLT in about 3 weeks…

And 234% on LQDT in just 8 weeks’ time.

That’s 234% in 8 weeks on the stock alone!

That’s not even counting the roughly 400% my members had the chance to make buying the call option on this trade.

Now, there are some things you need to look out for when using this loophole…

Because not every insider stock purchase signals a big opportunity.

For instance, a lot of companies offer stock buying plans for their executives…

Meaning they automatically purchase shares for them on a predetermined schedule.

Those trades don’t really tell us much of anything.

A lot of high-level executives are also compensated with stock options.

So when they convert those options into stock shares, it looks like a buy… but it’s not.

They’re just cashing out.

You also want to look at the size of the purchase in relation to the insider’s position.

For instance, a $25,000 investment sounds like a lot to you and me…

But it’s peanuts for a chief executive making $900,000-plus a year. There’s no real conviction there.

But if I see an insider investing 2 times… 3 times… even 5 times their annual salary?

Now that’s a trade I’m interested in.

My point is once you know how to filter out the insignificant activity…

And separate the signal from the noise…

You can use the SEC’s own website to find completely legal inside stock tips.

Let me show you what I mean…

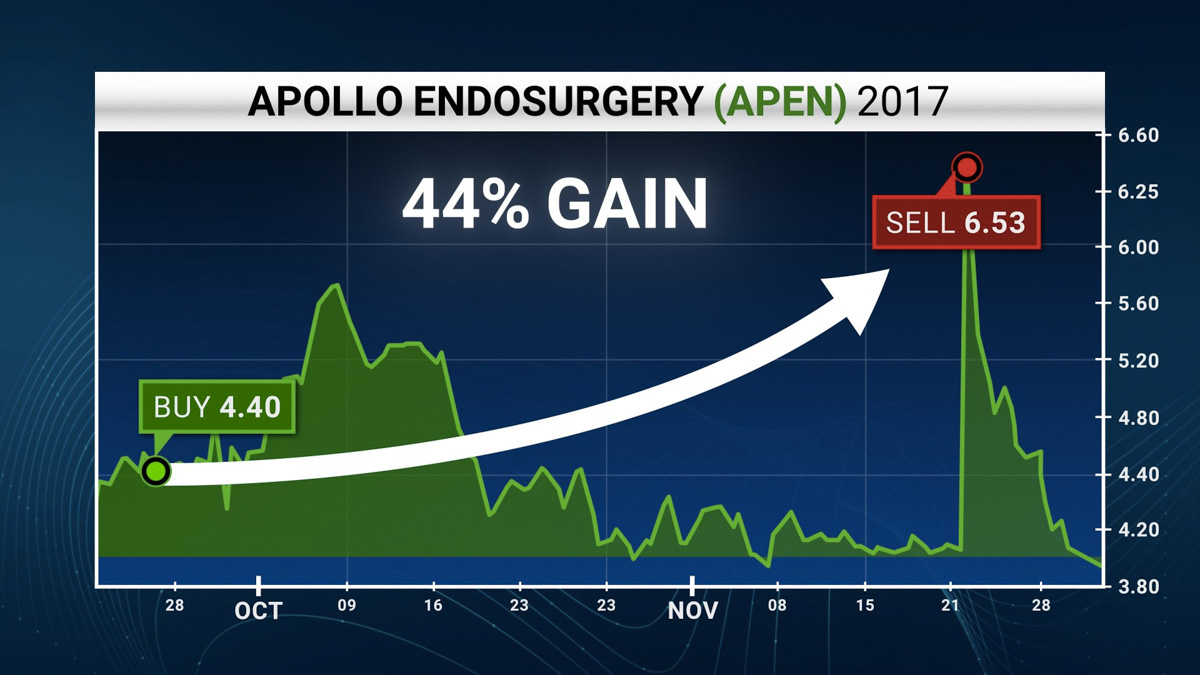

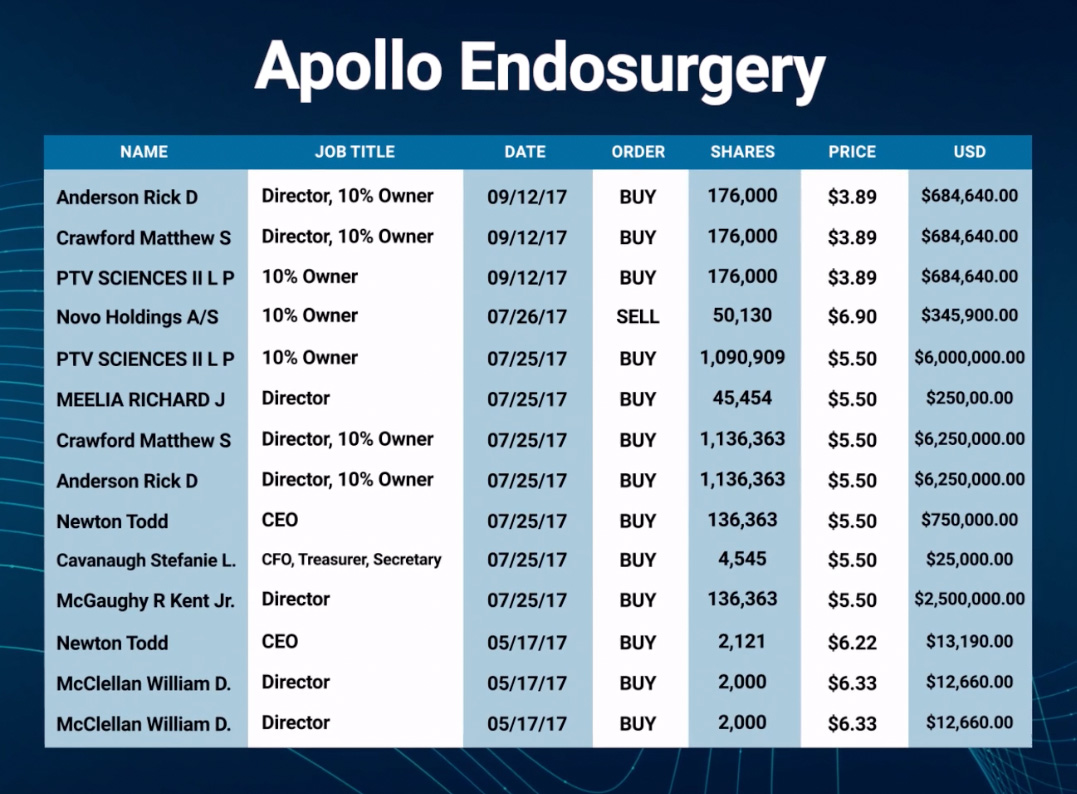

I used this insider buying strategy to alert my members to Apollo Endosurgery when it was trading for less than 5 bucks.

Eight weeks later, the company announced FDA clearance of its new flexible endoscopic suturing system.

The stock surged on the news, climbing as high as $6.53 overnight.

That meant a 44% stock return for my readers who invested when I sent the alert in only 8 weeks:

Now, I’m no medical expert.

Hell, I couldn’t even tell you what a flexible endoscopic suturing system is.

And even if I could, there was no way for me — or any other Main Street investor — to know that the company was on the verge of FDA clearance for its new suturing system.

But… who do you think did know that information?

Yeah… the same company insiders who started loading the boat with stock months ahead of the announcement!

Five company directors… the chief executive officer… the chief financial officer…

We’re talking more than $24 million personally invested by these insiders between May and September 2017 when I put this stock in front of my readers.

Think about it…

If you knew the insiders… the people running the company… were piling into a stock like this, would you think maybe they know something?

Yeah. Me too.

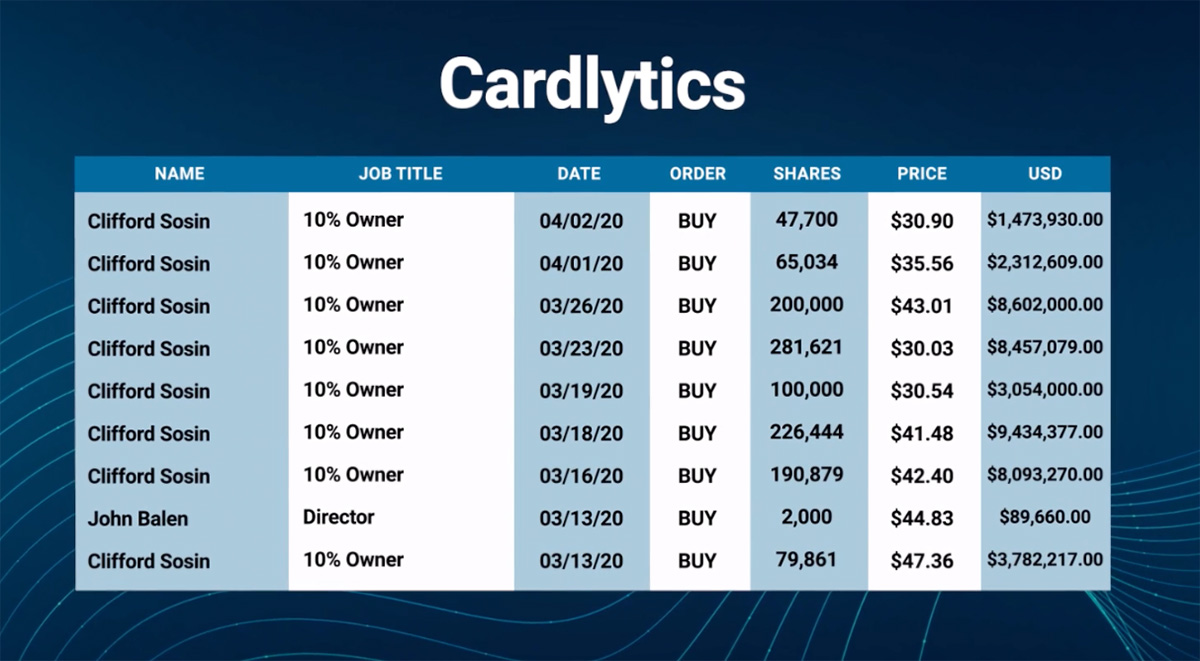

Remember CDLX, the stock that rocketed 115% in less than 60 days?

Just 4 weeks after I alerted my members to this stock, the company reported earnings that blew away expectations.

I advised my readers to sell some shares for $63.12, notching a 60% gain in one month.

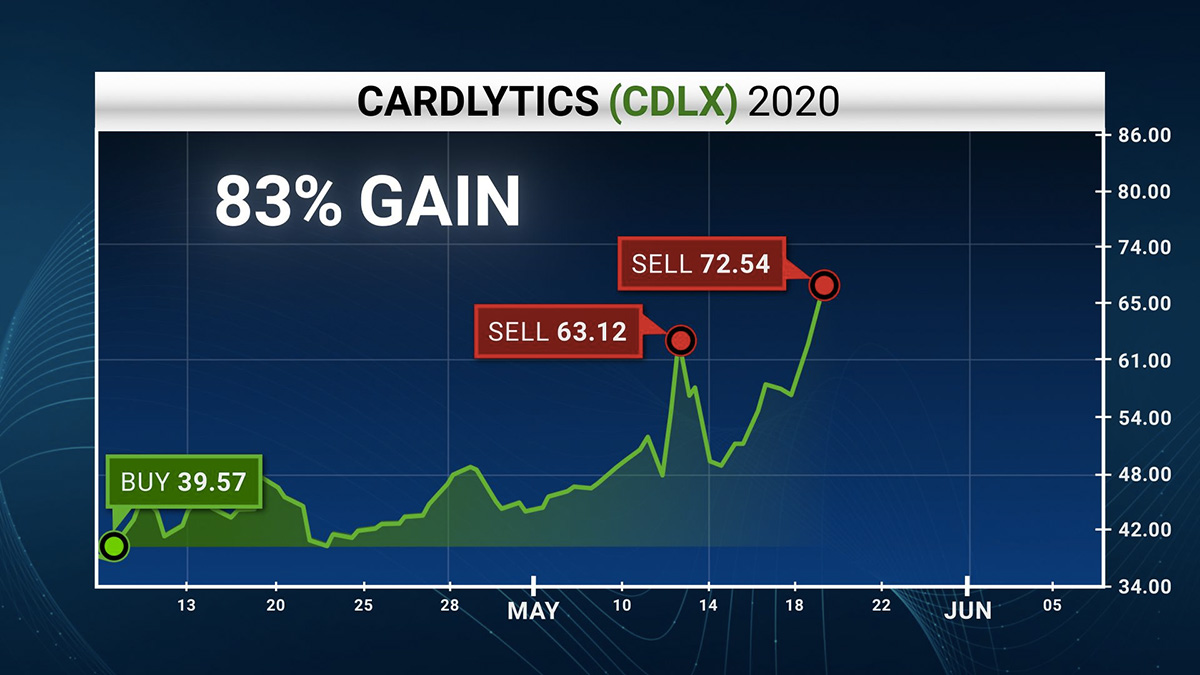

This stock wasn’t done yet, though.

Nine days later, those shares were worth $72.54, so we sold a few more for another 83% win…

And just 2 weeks after that?

The stock was worth $84.93…

And we sold another piece of the position to book a 115% payday.

Let me repeat: That’s a 115% stock gain…

More than double our money…

In less than 60 days’ time:

Now, again: I had no clue the company was on track for a huge earnings beat.

But when I saw this?

I knew something was brewing.

Clifford Sosin owns more than 10% of the company.

He has a seat on the board of directors.

He probably plays golf with the CEO.

I think it’s safe to say he knows what’s coming down the pike.

In a two-week buying spree, Clifford picked up more than $45 MILLION of CDLX stock.

All my readers and I had to do was hitch a ride on his coattails… all the way to an easy money-doubling stock win.

And remember Matador Resources, the oil company that was bleeding at the beginning of 2020 when the price of crude was plummeting?

I found Form 4s from the Chairman…

The CEO…

The Executive Vice President…

The CFO…

The President…

The Chief Operations Officer…

Several company directors…

All buying shares hand over fist.

This was, in fact, the biggest display of insider buying in the company’s history!

Guess what they knew that no one else did?

Matador had hedged all their oil production for the year.

Essentially, the company had pre-sold all of the crude oil it was going to pump out of the ground that year at pre-Covid prices…

Likely between $80 and $100 a barrel.

So when the price of crude collapsed, Matador executives could kick back with their feet up…

Because they knew they were on track for a massive earnings beat that would send the stock soaring.

My readers and I booked 155% in just 3 weeks…

And Matador went on to be one of our biggest wins to date, climbing 1,787% over the next 2 years…

And we still own it!

Here, I’ll show you another one…

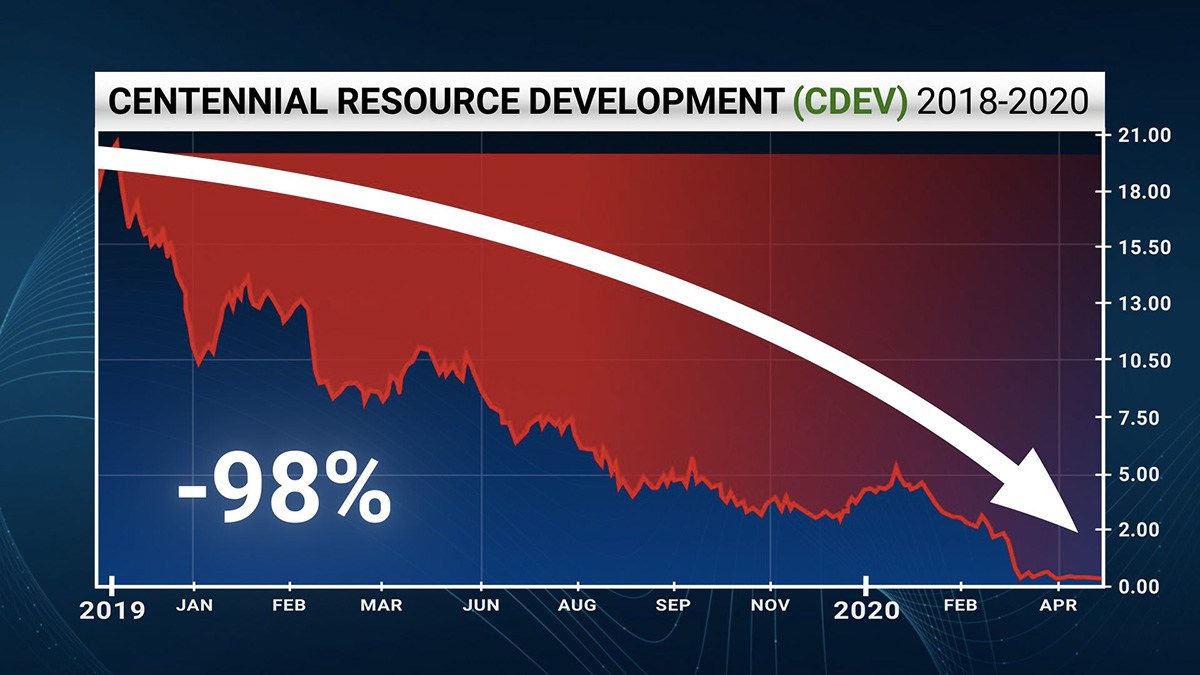

The company is Centennial Resource Development.

Just like Matador, this oil and gas firm caught my eye in early 2020…

When crude oil was the last thing most people were investing in.

Centennial had tumbled from $20 a share in late 2018 to as low as 25 cents in April 2020.

On paper, the company looked like it was running headfirst into bankruptcy.

Collapsing oil prices in the wake of a global pandemic were wreaking havoc on Centennial’s business…

But the insiders weren’t sweating it.

Centennial’s executives were in the process of temporarily halting shale operations to cut losses, and the bank had agreed to work with them on the debt.

While investors were betting on the stock going to zero, insiders knew better…

And in March, they started showing their hand.

First it was director Steven Shapiro buying 50,000 shares — that’s $96,000 of his personal money invested.

Then, Chief Financial Officer George Glyphis got in on the action.

George picked up 25,000 shares in March and another 25,000 in early May.

And then the big guns came out.

Private equity firm Riverstone Holdings holds a seat on Centennial’s board of directors as well as a 10% stake in the company.

In a nine-day run between May 13th and May 22nd, Riverstone purchased more than 13 million shares…

An investment of over $12 million.

This was a classic example of what I call a “cluster buy.”

It’s when we see multiple company insiders making large stock purchases all around the same time…

Giving us a VERY strong indication that the stock is ready to make a move.

Despite the roller coaster year crude oil was having, I officially called Centennial a buy on May 29, 2020 at 97 cents a share…

And just 10 days later, on June 8, shares were trading for $2.19.

That’s a 126% gain… more than double our money… in 10 DAYS.

Now, let me be perfectly clear:

This strategy is not foolproof.

Not every trade works out in our favor.

Because here’s the deal: EVERY trading system and strategy has its limitations…

And this one is no different.

These insiders are human just like you and me…

And even they can’t always foresee exactly how their stock will stand up in a punishing bear market.

But despite a historically awful year for investors, we’re beating the market by more than 40% thanks to these insiders…

While some of the best money managers and institutional funds in the world are bleeding.

And guess what else?

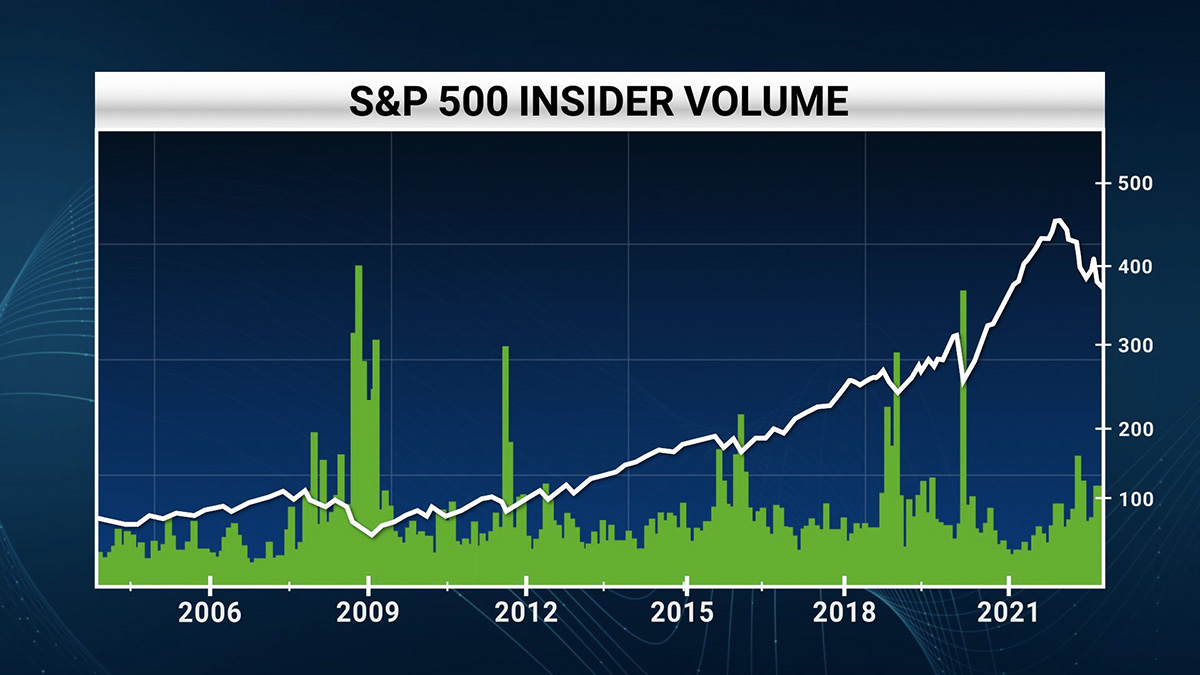

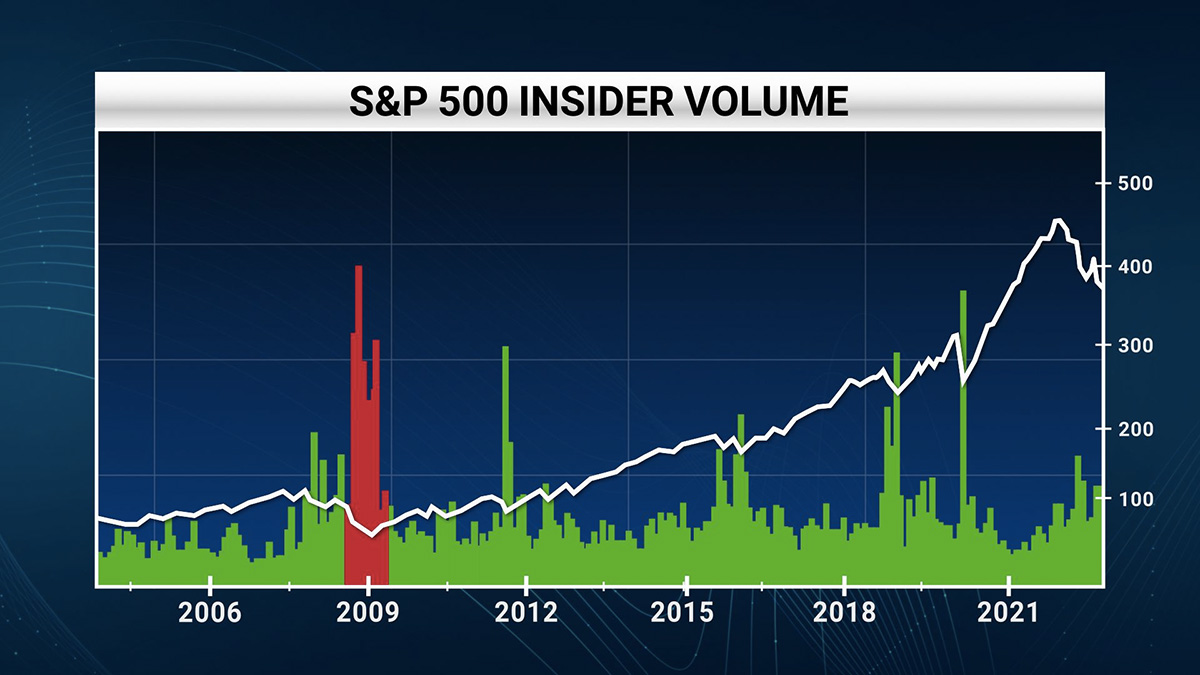

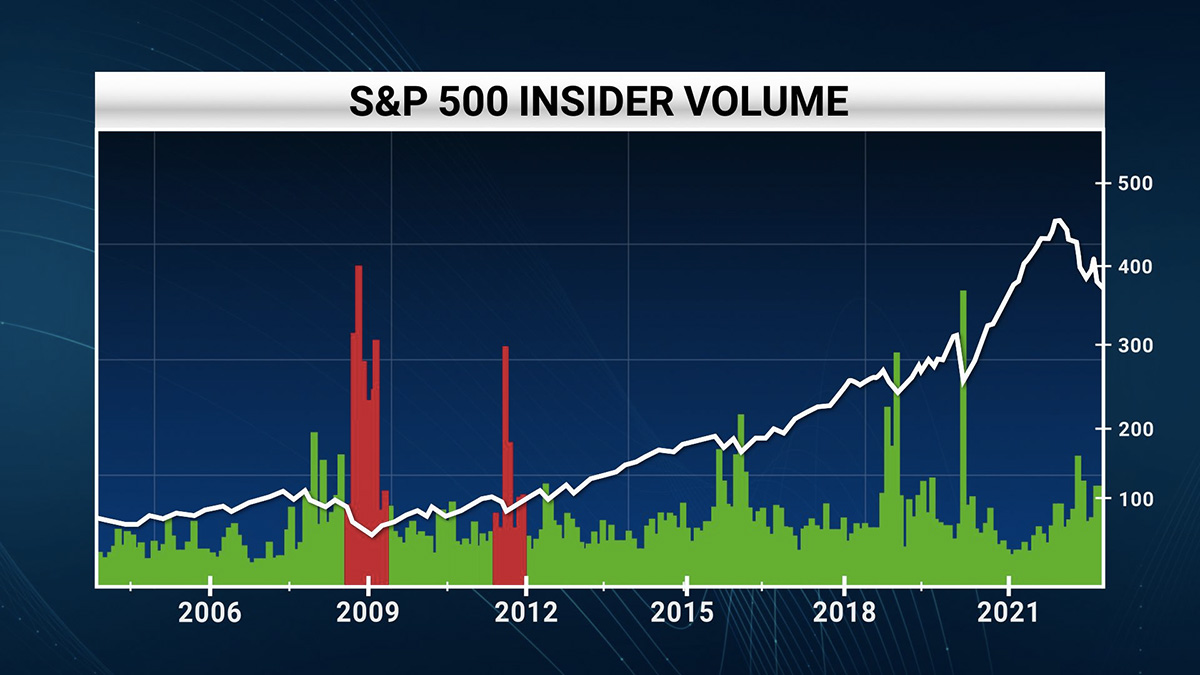

If you’re looking to time the market low, you cannot find a better indicator than corporate insiders.

In fact, in my opinion, they’re the ULTIMATE indicator.

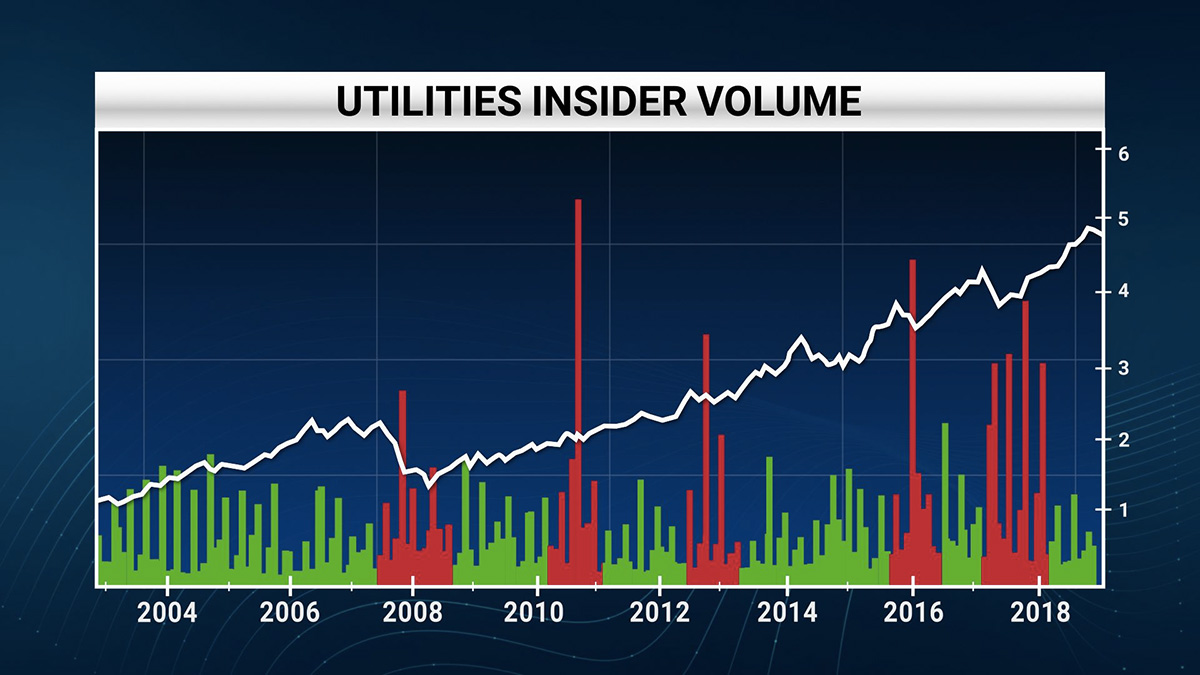

Take a look at this…

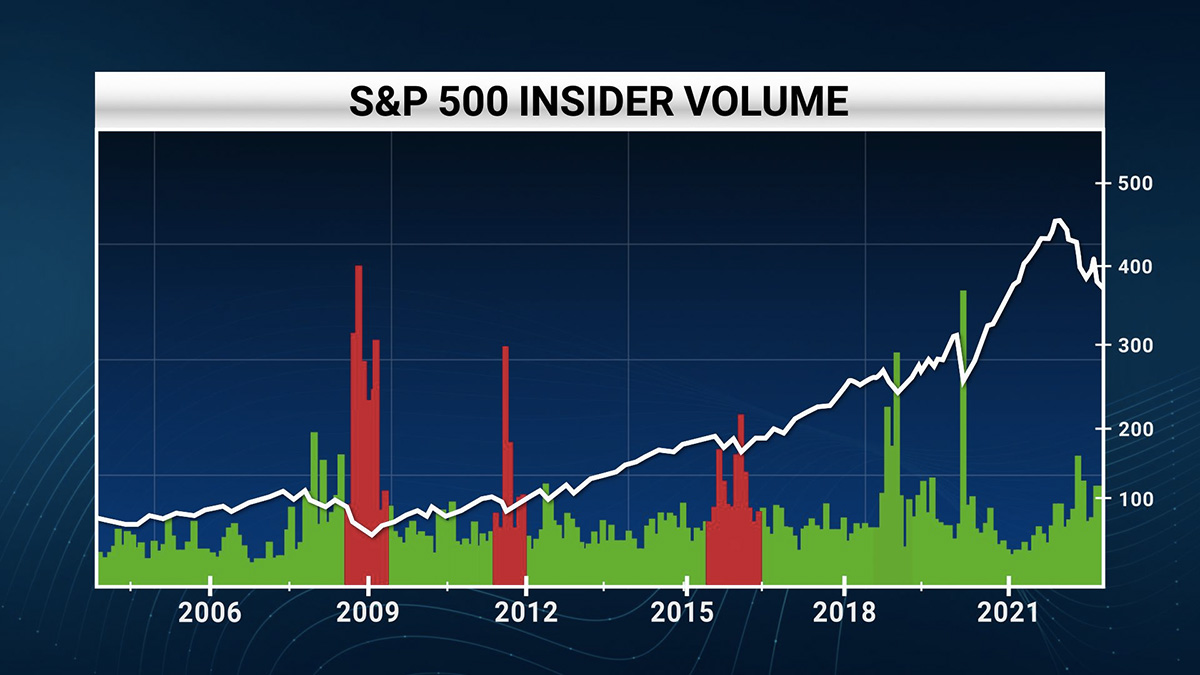

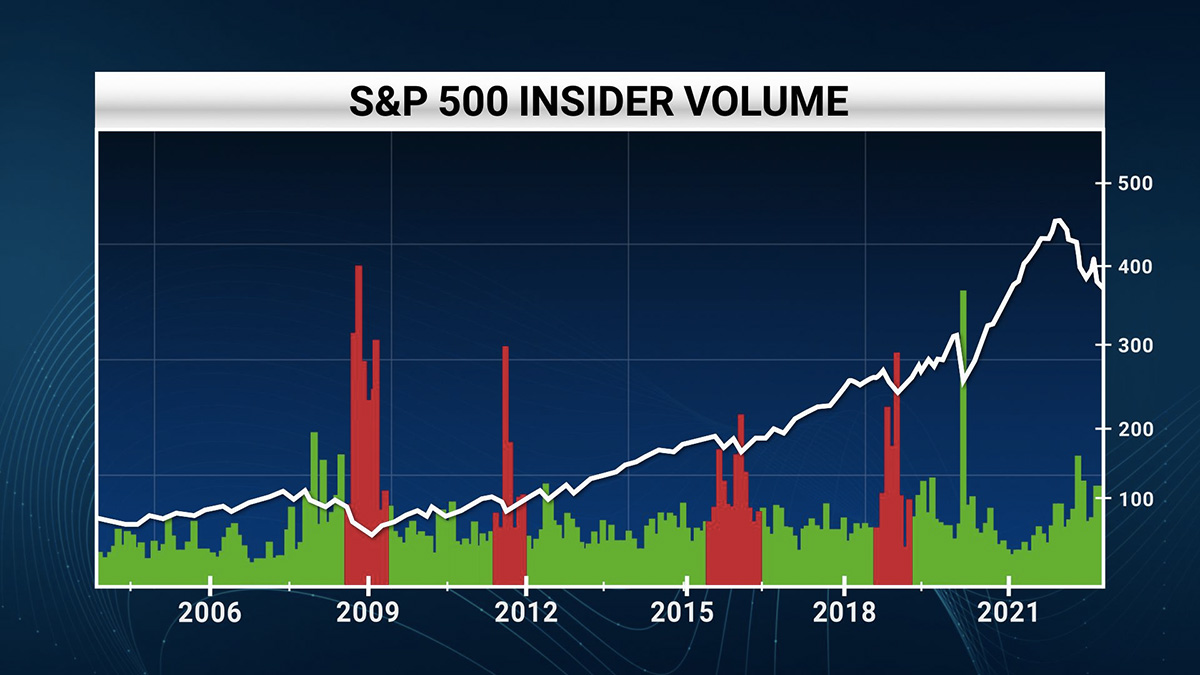

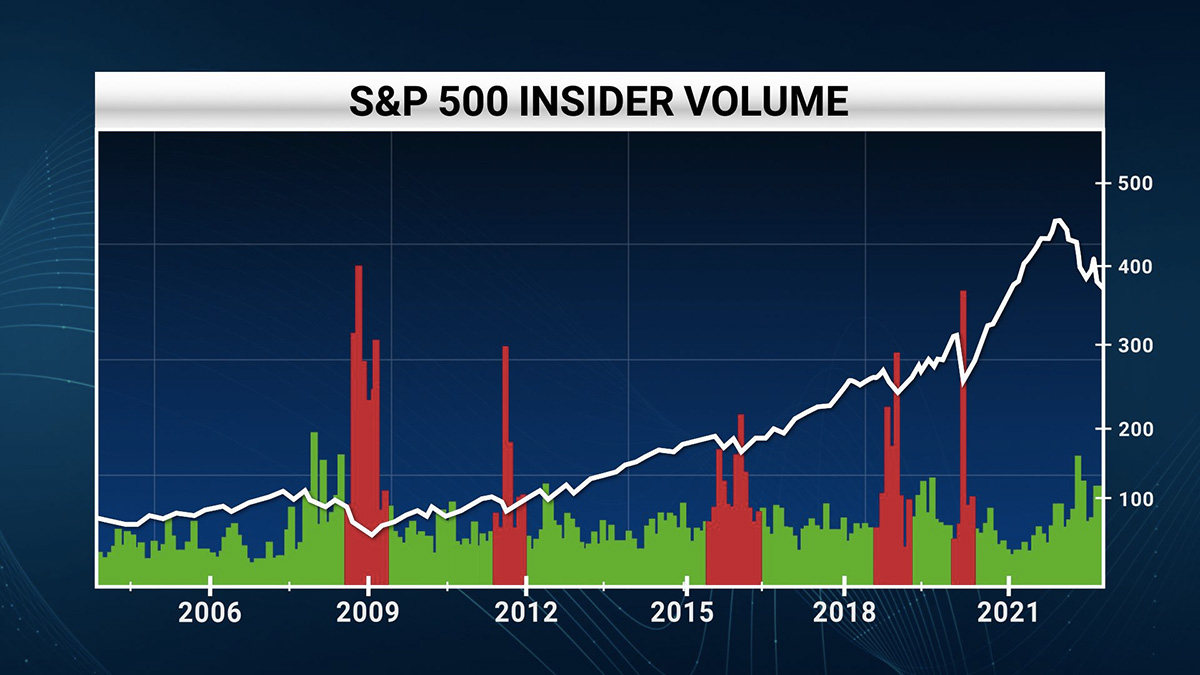

On this chart you can see how insider buying SPIKED at all of the most opportunistic times to buy.

They piled in at the end of the Great Recession in 2009…

And bought the 2011 low perfectly.

Insiders did it again in 2015…

2018…

And take a look at where we saw the biggest spike in insider buying in over a decade…

March 2020 — the dead bottom of the market following the Covid selloff:

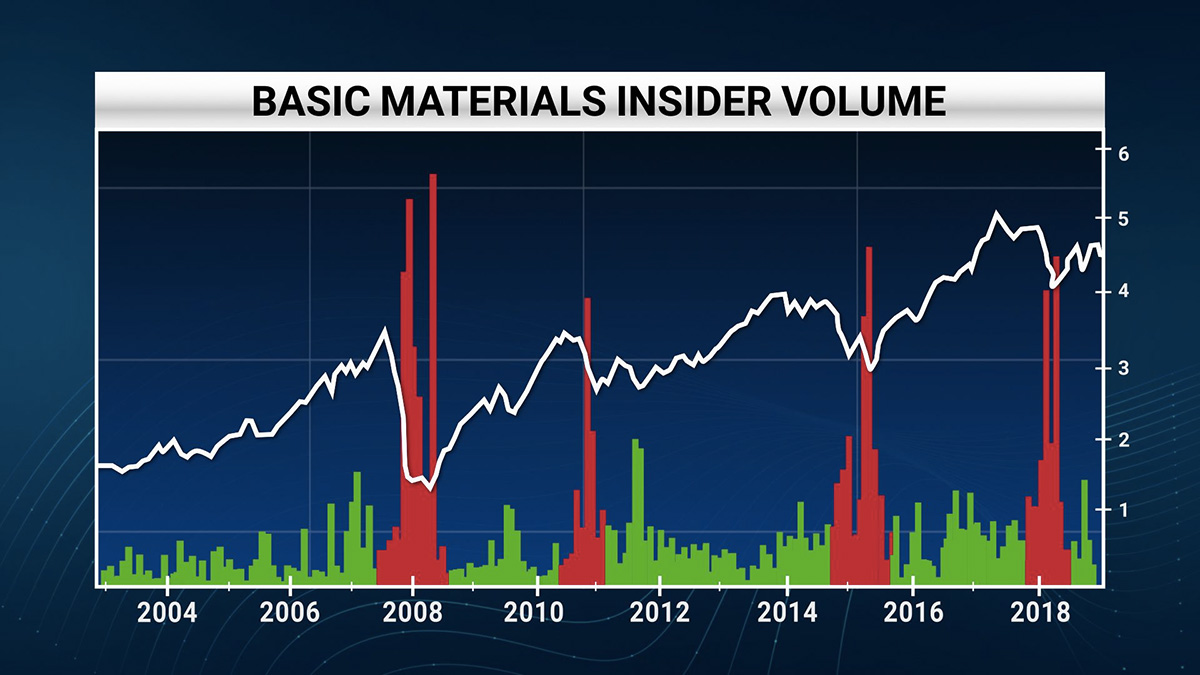

And check this out…

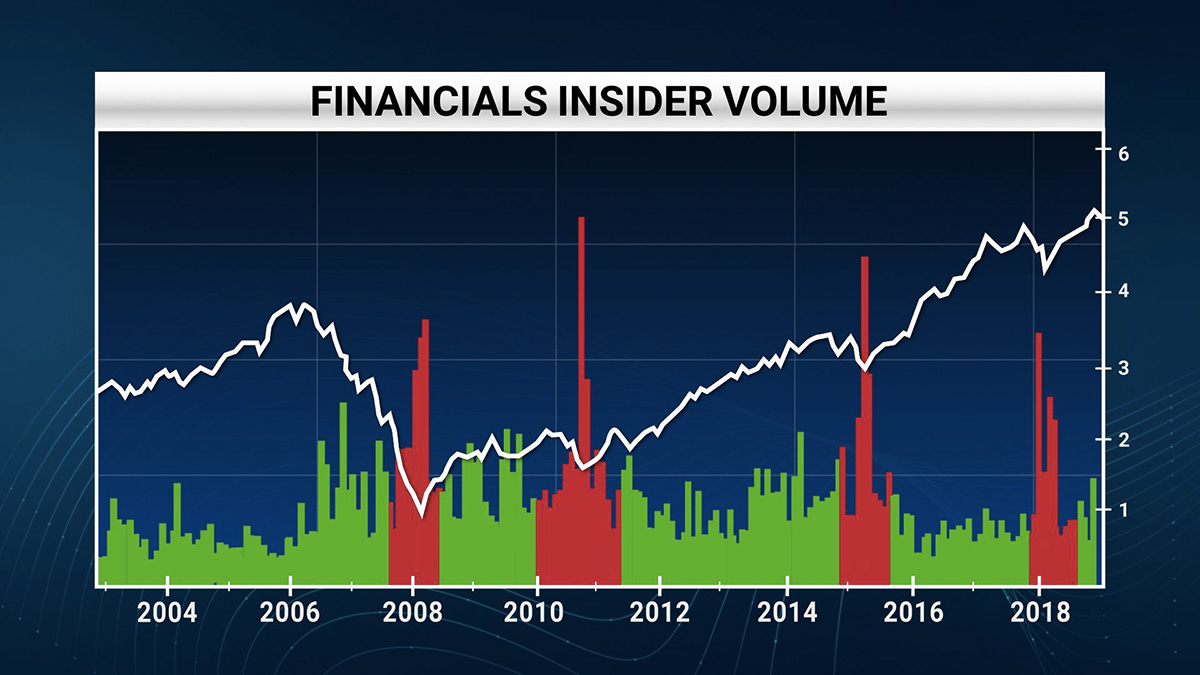

It’s like this across every market sector!

Financials…

Utilities…

Basic materials:

Remember when the price of lumber skyrocketed in 2020 right after the pandemic hit?

Who do you think was buying up all the lumber stocks and making a killing?

Yeah! Just look at this spike in insider buying:

They timed it perfectly!

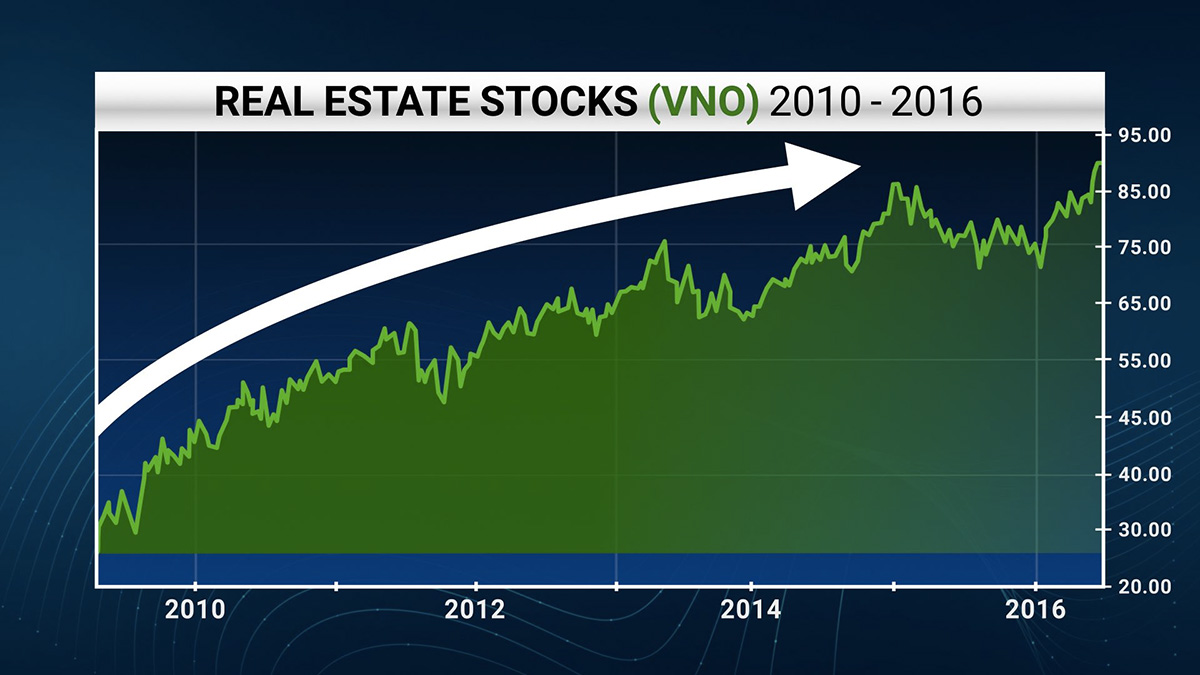

Just imagine buying bank stocks in 2009…

Or real estate in 2010.

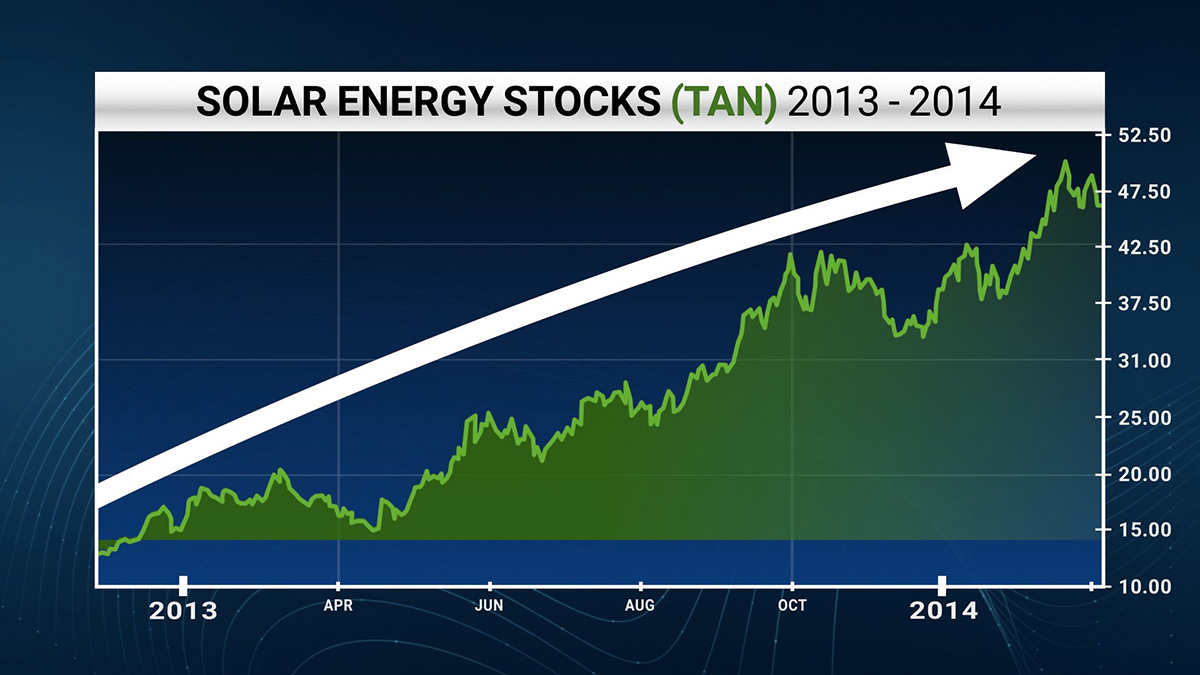

What if you’d have gotten into solar stocks in 2013…

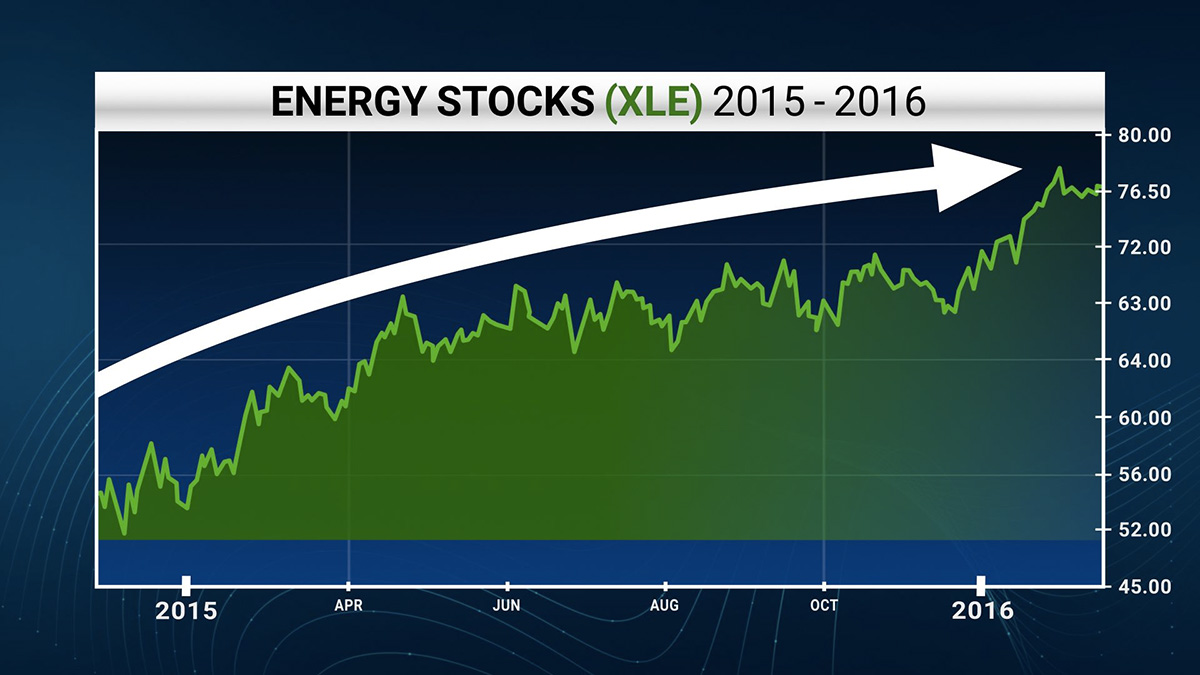

Or energy at the 2015 lows?

I’m telling you: Following these insiders is the closest thing to a crystal ball I’ve ever seen.

And here’s the best part:

I’ve just spotted THREE new stocks showing ALL the classic insider buy signals…

One is a computer development platform that allows users to build software on a single application.

If you don’t know what that means, don’t worry…

All you really need to know is the stock is being gobbled up by a deep-pocketed inside investor with a long track record of well-timed buys.

Just take a look at what happened the last time this insider started scooping up shares of this stock:

You couldn’t time these buys any more perfectly!

We’re talking 3 purchases worth a combined $12.5 million…

All within pennies of the May 2022 low.

The stock went on to climb 105% over the next 90 days.

… And now, they’re buying even more.

In fact, this insider just went in for more than 350,000 shares of this stock at a total investment of $24.8 million.

That’s DOUBLE the amount of their last buy!

And get this…

On top of a history of well-timed purchases in this particular company, this insider also has a LONG track record of investing in successful technology firms.

I’m talking companies like DocuSign, Slack, Impossible Foods, Giphy, 23andMe, Turo, Clover Health, Upstart and dozens more.

They’ve all received funding from this well-connected insider.

Given this stock’s previous price action and this massive new investment from a proven inside investor, I predict this stock could easily double in value over the next 6 to 12 weeks.

And that’s just one of THREE piping-hot inside opportunities I’ve just uncovered.

What do these insiders know?

Why are they buying now?

I can’t say for sure.

What I DO know is that these insiders have access to privileged, non-public information about their companies…

The kind of information that has historically made insiders very, very rich.

Of course, nothing is ever guaranteed…

But based on my research, I believe all 3 of these opportunities could be VERY profitable.

I’ve just wrapped up a brand-new report on these stocks called Uncovered: 3 Stocks Corporate Insiders Can’t Get Enough Of.

Inside this detailed report, you’ll find everything you need to get in on these urgent opportunities…

Including what to buy, at what prices, and where to place your stops. All you have to do is execute.

With these 3 stocks, you could be well on your way to following insiders to exceptional profits immediately...

And I’m ready to send it to you right now when you take advantage of today’s special offer.

So here’s the deal…

Every stock win I’ve shown you today…

And the annual gains that crushed virtually every other stock picker on the planet for 3 years running…

They’re the results of real trades that I put in front of my readers inside my exclusive, members-only service where I do all the research…

And send out a detailed alert when I see a juicy opportunity.

It is my most premium service, and it carries a premium price tag.

I’m sure you’d expect that for a service that’s consistently outperformed some of the best investors alive…

And delivered a 292.9% annual gain in 2020 alone.

I’ve helped mom and pop investors get in early on stocks like Sierra Oncology just a few weeks before the company got acquired at a premium…

Handing us a 77% stock gain in only 2 months.

Then there was Tracon Pharmaceuticals that jumped 112% just 60 days after I sent the alert…

And the 128% gain we booked on Resideo Technologies.

And that’s just a small handful of the wins we’ve seen!

Following insiders has led us to wins of 50% on REI stock…

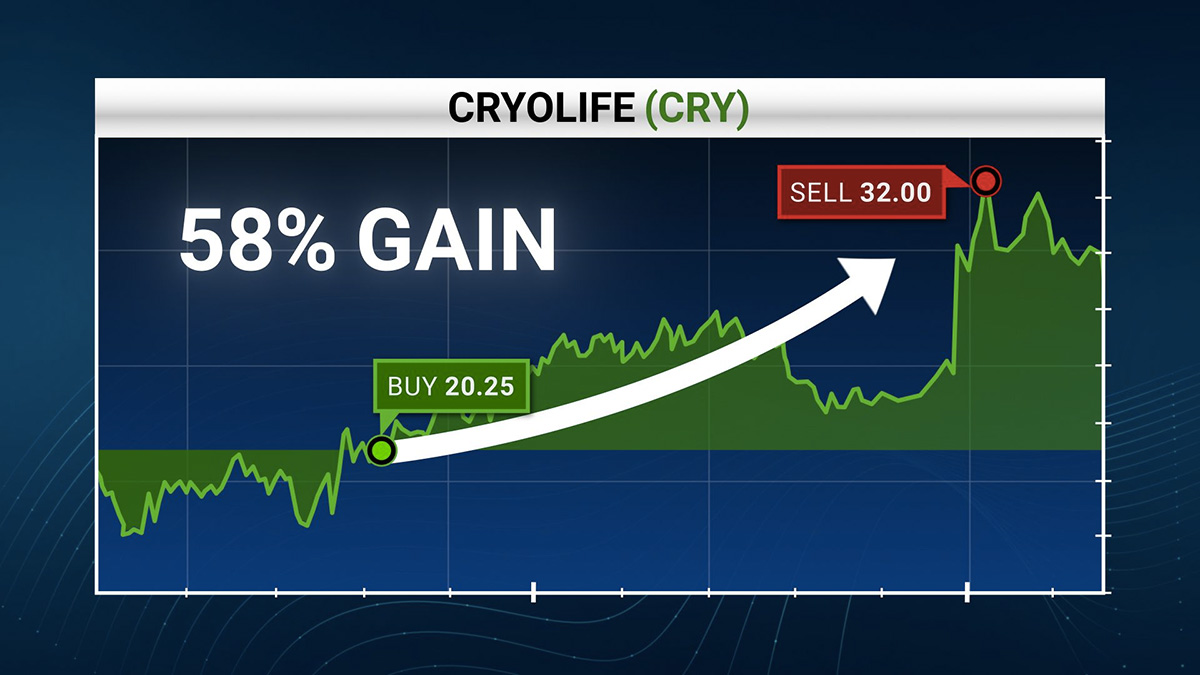

58% on CRY…

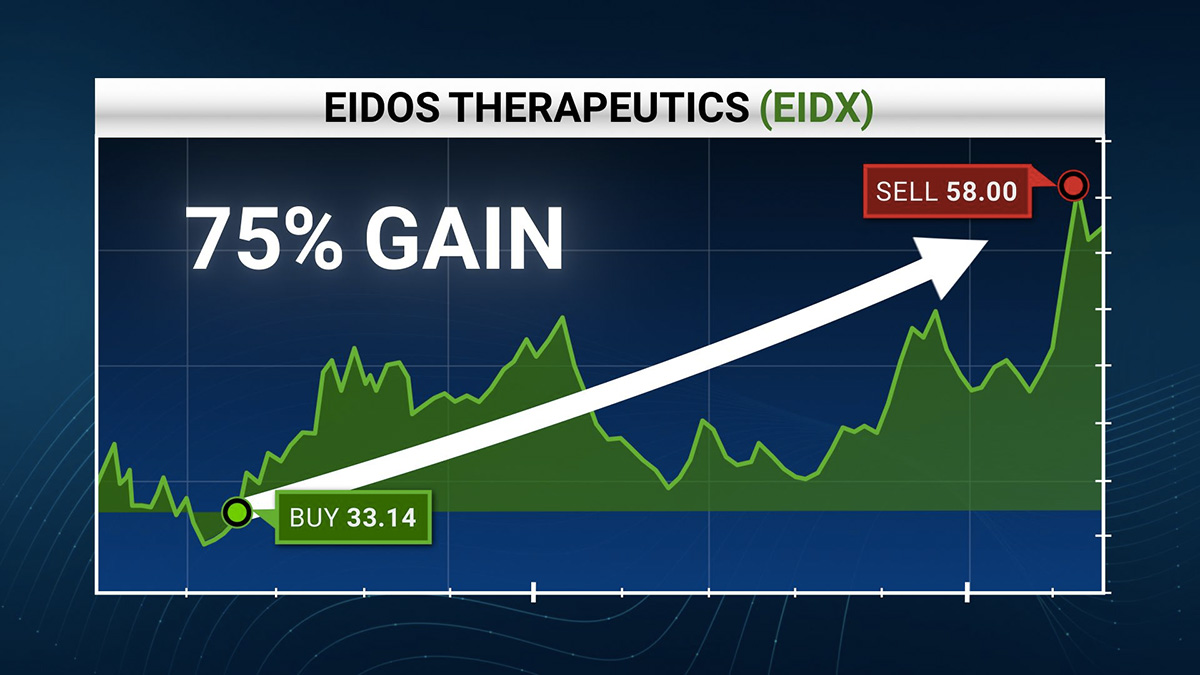

75% on EIDX…

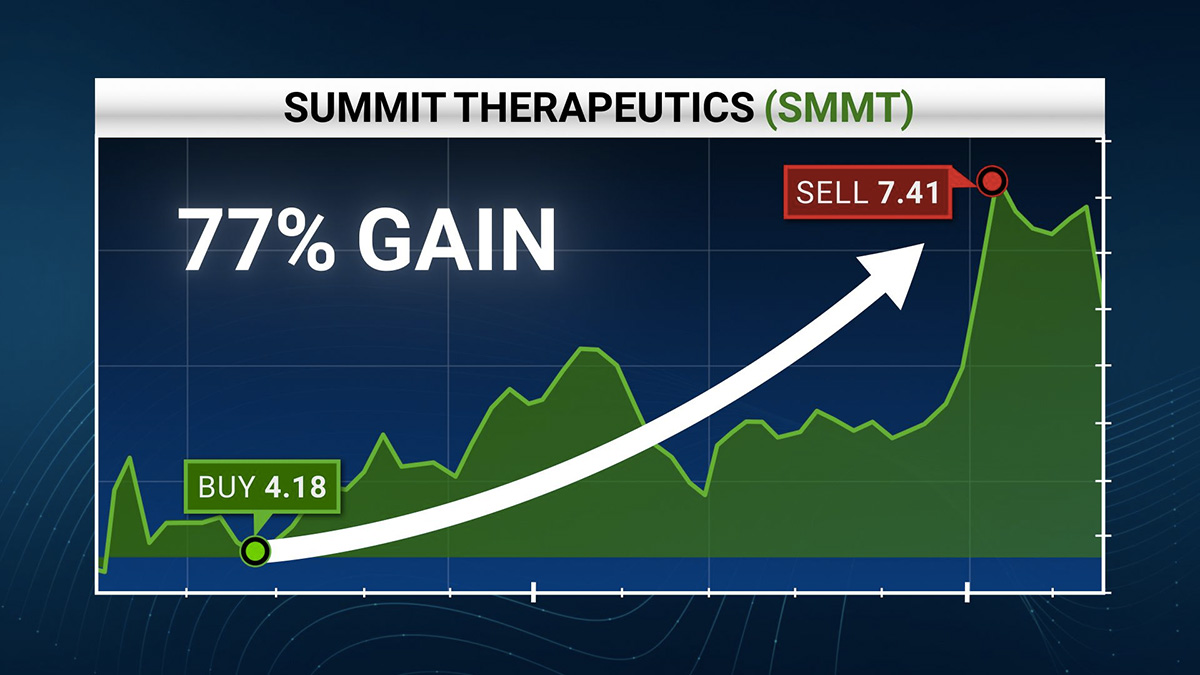

77% on SMMT…

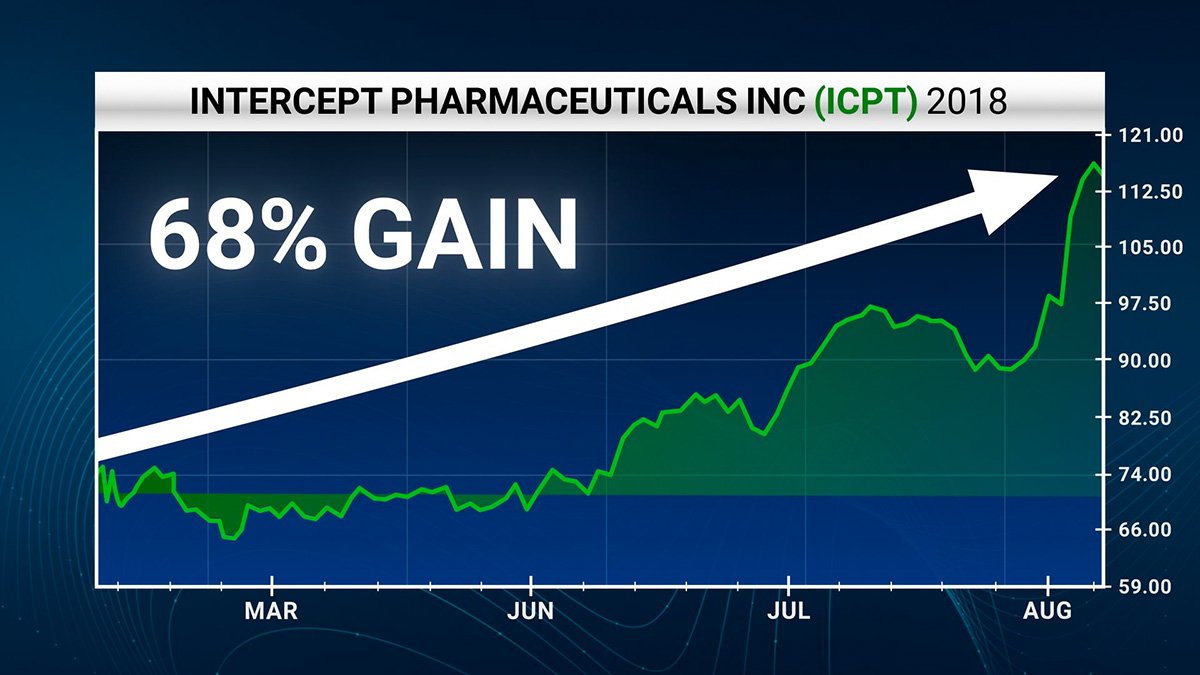

68% on ICPT…

106% on COST…

113% on IIPR…

163% on VOXX…

I could go on and on.

People have been begging me for YEARS to spill my secrets for following insiders to these types of gains…

But I’ve never done it — not even for my clients who have paid upward of $6,000 for access to my insider picks.

That’s why today’s offer is so special.

You see, I’ve recently launched a new venture.

It’s called Undercover Trader…

This research service gives you everything you need to find the same inside intelligence that led me to every explosive stock win I’ve just shown you.

And right now, I’m offering a special deal to anyone who joins today.

The service works like this…

Every month, I send you a brand-new edition of Follow the Money…

My exclusive insider intelligence report.

In this members-only dossier, I’m breaking down the biggest inside investment trends from the corporate boardrooms to Capitol Hill.

You’ll discover which market sectors are seeing the MOST insider buying, both from politicians and high-ranking company officers…

As well as the sectors and industries they’re dropping like a bad habit.

Between the nation’s top corporate executives and our representatives in Congress, we’re talking about some of the most elite investors on the planet…

True insiders with access to material, non-public, market-moving information.

As an Undercover Trader member, you’ll get Follow the Money delivered directly to your inbox every single month for the life of your membership.

But that’s just the beginning.

Every single Friday, you’ll receive a members-only video briefing where I’ll break down all the stock market action of the week.

We’ll look at the major market themes and trends…

And I’ll tell you what I see coming that could have big impacts not only on insider buying, but on the overall stock market, as well.

This way, I can stay in touch and let you know what I’m seeing in real time.

This monthly and weekly research is exclusive to Undercover Trader.

You won’t find it anywhere else on the internet…

But it would be worthless without knowing how to leverage this information the same way I do for my premium members.

That’s why I’m including exclusive access to my masterclass…

The Undercover Trader’s Ultimate Guide to Insider Buying:

In this three-part class I’m laying out my entire insider stock buying strategy step by step, from top to bottom.

This masterclass reveals all my secrets…

Every tip and trick I’ve learned over 10 years of following inside investors, including the shockingly simple way to use the SEC’s website to unearth a treasure trove of completely legal inside stock tips.

I’ll also show you the members-only website that lets you scan for insider trades in real-time and view insiders’ track records…

So you can separate the insiders worth following from the ones who have shown they don’t really know what they’re doing.

You’ll also discover:

I’ll also show you the serious advantages we have over the insiders…

Things like the Short Swing Rule that requires them to hold stocks for at least 6 months…

And how it puts us onto stocks poised for big, long-term gains.

I’ve distilled a decade’s worth of experience with this proven strategy into this comprehensive course…

And once you’ve completed the Ultimate Guide to Insider Buying masterclass, you’ll be armed with everything you need to find “inside” opportunities just like the ones I’ve shown you here today.

So, to recap…

When you join Undercover Trader today, I’m going to immediately send you a copy of my new report, Uncovered: 3 Stocks Corporate Insiders Can’t Get Enough Of…

Where you’ll get full details including the names and ticker symbols of the three hottest insider stocks I’m seeing right now.

You’ll also unlock instant, on-demand access to the Undercover Trader’s Ultimate Guide to Insider Buying masterclass…

Which means you can watch and rewatch it whenever you want, as many times as you want.

You’ll also get Follow the Money, my monthly insider intelligence report sent directly to your inbox…

And you’ll be on my exclusive list to receive the weekly Undercover Trader video briefing, which comes out every Friday.

Now you might be thinking, “This all sounds great, Ross…

But I’m barely getting started as a stock trader!”

I’ve got you covered.

In addition to the bonus report, the masterclass, the monthly intelligence report and the weekly briefing, I’m throwing in three more exclusive video courses for those who act today.

The first is called Stock Trading Simplified, and it’s exactly what it sounds like.

In this course I walk you through the fundamentals of stock trading…

Things like how to read a chart, how to enter and exit positions, and how to open your first brokerage account.

Next is Risk Management 101.

This course alone will be worth the price of admission for a lot of people, even if you’ve been trading for a while.

Here you’ll learn my favorite methods for protecting your capital with battle-tested risk management strategies…

Because in trading, scoring big wins is only half the equation.

The other half is keeping your losses as small as you can…

And I’ll show you exactly how I do that in my personal trading in this exclusive course that’s only available for Undercover Trader members.

Finally, I’m going to show you in detail how I strategically exit stock positions to de-risk my trades…

And maximize my earning potential in the Scale the Sale video course.

Remember the Cardlytics trade I showed you earlier?

The one where we took profits three times as the stock continued to gain value?

We also did it with Matador Resources… Centennial Development Resources… Resideo Technologies… Liquidity Services… Tracon Pharmaceuticals…

The list goes on and on.

Listen, there’s nothing worse than buying at the right time, just before a stock makes a huge move higher…

Only to watch your profits evaporate when the stock turns south.

Systematically booking profits on your trades the way I’ll show you is one of the most powerful stock strategies I know of…

But in my experience, it’s wildly underused.

I’ll show you exactly how I do it in Scale the Sale so that you’ll have another giant leg up in the market.

Now as I mentioned, this is the first time I’ve EVER offered anything like this…

A chance for you to learn ALL my secrets for finding perfectly legal inside stock tips in one place.

Between the masterclass…

The monthly and weekly research…

AND the three bonus video courses…

We’re talking thousands of dollars in value.

… And that’s not even counting the bonus report with three stocks that have the potential to hand you some SERIOUS profits over the coming weeks!

But I’m not going to ask you for thousands of dollars.

Not even close.

A full year of Undercover Trader retails for $197…

But when you take action today — right here, right now…

I’m going to give you an entire year of Undercover Trader…

INCLUDING the three-stock bonus report…

For just $49.

Seriously!

We’re talking less than the cost of a steak dinner for two…

For instant access to three stocks that top-level insiders are putting their own money into right now…

PLUS on-demand access to my masterclass, where you’ll learn ALL my secrets for finding completely legal inside stock tips, as well as…

Now at this point, I don’t think there’s anything I could possibly do to make this any more of a “no brainer”...

But I’m going to try.

So here it is:

My 365-day “Every Penny Back Guarantee.”

If at ANY TIME over the next year you decide that Undercover Trader isn’t for you, simply contact my Florida-based support team, and we’ll refund every penny of your subscription fee.

It’s that simple.

Remember: My insider buying masterclass, my weekly and monthly insider research, and these three video courses are ONLY available to Undercover Trader members through this very special offer.

You will not find them anywhere else.

Now it’s time for a decision.

Right now, you’ve got three choices…

Choice number one is to do nothing… and stay exactly where you are right now.

If your life wouldn’t improve at all by making some extra money in the stock market…

And if the chance to make major gains by following the world’s most elite insiders won’t move the needle for you…

Then this is not for you.

But if you’d like the shot at making the kinds of profits I’ve shown you today, then that leaves you with two other choices.

Choice two is to do it yourself.

You can dedicate YEARS to learning how to find the most opportunistic Form 4s on the SEC’s website on your own…

Spend hours each day keeping up with the transactions of all the political and corporate heavyweights to see where the smart money is moving…

And learning all the techniques for maximizing profits and keeping losses small.

If you’re willing to put in the years of work it takes to learn and master these skills, you might be able to pull it off.

Or, you can take option three…

And let me share a lifetime of education, experience, and expertise with you.

I’ll show you all my secrets for insider buying, and give you full access to my ongoing research and market analysis.

All you have to do is say “Yes,” and I’ll give you the keys to the kingdom right now.

Just ask yourself: What would even ONE of these winning trades be worth?

If you knew that you’d have the chance to turn $5,000 into $16,500 like you could have with our IIPR trade…

Or a $2,500 stake into $47,175 like you could have with MTDR…

How much would that be worth to you?

Would it be worth paying $197?

How about $49… a full 75% LESS than the normal retail price of this service?

Listen: everybody says they want more for themselves in life… more for their families…

More for their kids, and their grandkids.

But you and I both know that only a small handful of those people are willing to do what it takes to make it happen.

So the real question is: Are you a person who sits around and talks about what they want to do?

Or are you the rare person who does what it takes?

I’m ready to send you everything you need to get started…

Click the green button on your screen right now… and I’ll see you on the inside.

THIS MATERIAL IS OFFERED FOR EDUCATIONAL AND GENERAL INFORMATIONAL PURPOSES ONLY. NO INVESTMENT ADVICE IS OFFERED.

This is an advertisement for online information courses, workshops, classes and other educational programs relating to finance and investing. It is not an advertisement for investment advice. Neither Traders Agency, LLC nor its principals or affiliates are registered investment, legal, or tax advisors or broker/dealers. All content, materials and information found in any product or service that Traders™ Agency offers and that you have access to or consume must be understood by you to be for educational and general informational purposes only.

The information provided to you by Traders™ Agency is general and impersonal in nature and does not take into account your individual investment objectives, financial situations, risk tolerances, or needs. Before implementing or using any information provided to you by Traders™ Agency and before making any financial or investment decision, you must confirm the accuracy of such information and applicability and appropriateness of any decision to your personal situation with your own analysis or by consultation with a licensed/registered and qualified investment professional.

While Traders Agency, LLC works hard to ensure that the content, materials and information we provide is up to date, we cannot and do not guarantee its accuracy or completeness. Additionally, unintended errors and misprints may occur. Any commentary, analysis, opinions, recommendations, or other statements herein represent the personal and subjective views of Traders Agency, LLC and our affiliates and are subject to change at any time without notice. The content, materials and information provided by Traders Agency, LLC is obtained from sources that Traders Agency, LLC believes to be reliable. However, Traders Agency, LLC does not independently verify or investigate all such information, and therefore you must and with your registered/licensed financial advisor conduct your own verification and investigation of content, materials, and information provided by Traders Agency, LLC. Neither Traders Agency, LLC nor any of its affiliates guarantees the accuracy or completeness of such content, materials or information. To the maximum extent permitted by law, Traders Agency, LLC disclaims any and all liability in the event any information, commentary, analysis, opinion, or recommendation proves to be inaccurate, incomplete, unreliable, or results in you having any kind of investment or other losses.

Traders Agency LLC intends that the information contained in this advertisement is truthful and not misleading in any way. Accordingly, you are fully informed that none of the information, material, or courses that Traders Agency, LLC offers constitute investment advice and all such information is provided for educational and informational purposes only.

INVESTING INVOLVES SUBSTANTIAL RISKS, INCLUDING THE POSSIBLE LOSS OF PRINCIPAL. PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS. YOU ARE RESPONSIBLE FOR PERFORMING YOUR OWN ANALYSIS OR CONSULTING WITH YOUR PERSONAL LICENSED/REGISTERED ADVISORS BEFORE MAKING ANY INVESTMENT DECISION.

Privacy Policy | Terms & Conditions | Risk Disclaimer | TCPA